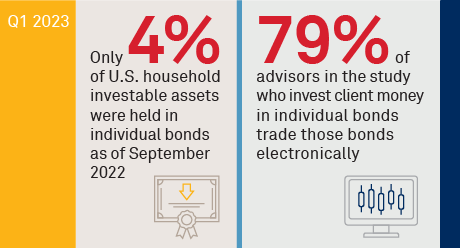

According to the Federal Reserve, U.S. households held nearly $108 trillion in investable assets at the end of September 2022. Nine percent of the total—$9.3 trillion—was held in fixed income. Of that $9.3 trillion, $4.3 trillion (only 4% of the total) was in “directly held debt securities,” or, in simpler terms, bonds.

While nearly $4 trillion is nothing to sneeze at, the data shows that bonds have increasingly fallen out of favor with retail investors. That $4 trillion was $5 trillion a decade earlier in 2012, and accounted for 9% of invested assets. As another point of comparison, directly held stock accounted for 16% of invested assets in 2012 and 22% in 2022. That equates to a near tripling of the value of assets held (noting, of course, that equities markets had an incredible bull run in that period). And lastly, at 4% of invested assets today, bonds are the smallest piece of the pie for U.S.-based retail investors, dwarfed by everything else—equities, bank deposits, pension fund assets, and more.

But evidence now exists that retail bond buying is starting to make a comeback. November 2022 was a record month for reported bond transactions, with most of the growth coming from retail-sized orders. Bonds directly held by U.S. households jumped $500 billion from June to September of 2022. And given nearly risk-free returns of 4% or more, holding individual bonds to maturity gives investors what they have dreamed of for at least the past decade—a true fixed income.

MethodologyCoalition Greenwich gathered responses from 537 financial advisors in the United States in August 2022. The advisors worked across several client segments for a diverse set of firms that included wirehouses, insurance companies, registered investment advisors, and institutional asset managers. The research also includes data from Greenwich MarketView and the U.S. Federal Reserve.