About 54% of Asian intermediaries have Alternatives funds on their platforms, with a higher propensity among Private Banks than Retail Banks; by country, Singapore intermediaries have the highest adoption rate at 82%, with the lowest in Taiwan at 39...

2024 Key Trends in Institutional Asset Management - United States

Review key industry trends for the institutional investors market in the U.S.

This report provides detailed information from Asia-based equity investors.

This report provides detailed information from European-based equity investors.

2024 European, Asian, and Japanese Convertibles Market Trends

This report provides detailed information from Europe, Asia and Japan-based convertibles investors.

This report provides detailed information from U.S.-based small and mid-cap equity investors.

This report provides detailed information from North America-based convertibles investors.

This report provides detailed information from Europe-based equity derivatives investors.

Muni Bond Market Structure 2025: The Dealer View

The U.S. fixed-income market has seen renewed excitement and an increase in interest in the past two years, following aggressive interest rate hikes by the Federal Reserve.

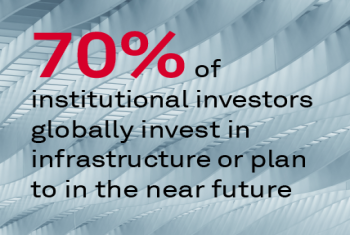

This report covers the latest trends in infrastructure investing based on feedback with influential asset owners.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial News: Banks' total markets revenue is expected to reach $259bn in 2025- the highest...December 10, 2025

-

S&P MI: Major U.S. and European banks are on course to book a total of $346 billion in revenue...December 9, 2025

-

The Desk: Retail Investors are leaning back into bonds, according to a recent Crisil Coalition...November 27, 2025