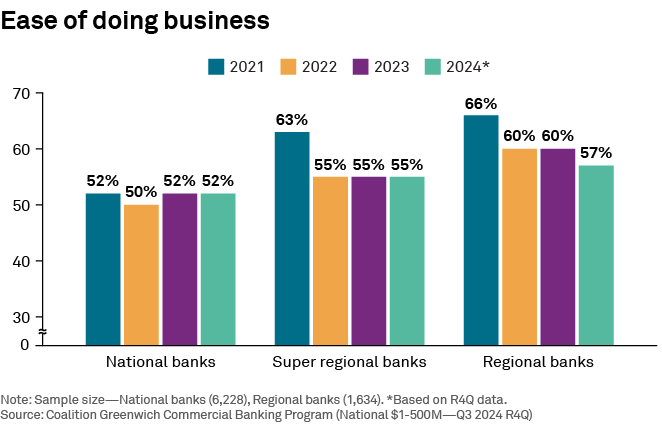

In recent years, client satisfaction scores in commercial banking have diverged between the U.S. national banks and regional/super-regional banks, with scores holding steady for the former and falling for the latter. We believe one driver of this divergence is the fact that huge investments in technology among the biggest U.S. banks are starting to pay off, eroding regional banks’ ability to differentiate on the white glove “high-touch” service model alone. Digital capabilities including AI are becoming increasingly expected by bank clients.

Among national banks’ technology investments, artificial intelligence (AI) is impossible to ignore. AI was one of the topics for which banks nominated a record number of capabilities to our Digital Transformation Benchmarking Study, indicating a renewed industry focus and investment in this area across leading global banks.

The AI-enhanced banker

To paraphrase Amazon CEO Andy Jassy, bankers will not be replaced with AI, they will be replaced with other bankers who learn to effectively harness the power of AI.

We strongly believe that the human banker will remain the cornerstone of commercial and corporate banking relationships. Corporate executives value the advice and perspective of experienced bankers with whom they have a real-life relationship—especially in times of stress.

But the human banker of the future will have capabilities significantly enhanced by AI. AI solutions are already serving as digital personal assistants to bankers, taking on routine tasks and freeing up bankers to spend more time with clients and respond more quickly to client inquiries, while also covering more clients. Going forward, AI will make bankers more effective in their client interactions by customizing presentations, generating personalized insights and recommendations, and contributing to solutions tailored to individual clients.

The ROI of AI investment

Corporate and commercial banking clients will feel the benefits of those investments in the form of improved customer service, enhanced analytics and insights, stronger fraud prevention, and a host of additional areas. As those benefits unfold, AI will become a powerful driver of both bank revenue growth and profitability, thanks to its ability to automate routine tasks, create efficiencies and reduce operational costs.

Banks that take the lead in applying AI and generating those enhancements for their clients will find themselves in a strong position. As this technology is new and quickly accelerating, it’s important to stay ahead of competitors in this rapidly changing space. Our Digital Transformation Benchmarking Study is particularly useful for understanding how your bank compares to its peers, as well as acknowledging your bank’s competitive strengths and opportunities for further investment.

Amos Welder, Relationship Director—Corporate Commercial Banking, and Kassie Krivo, Senior Relationship Manager—Corporate Banking, are the authors of this publication.