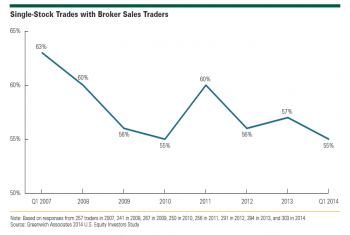

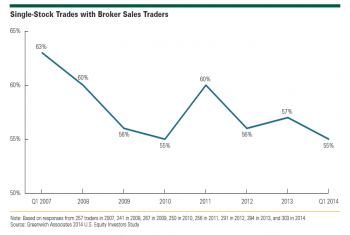

Armed with next generation technology, the sales trader of the future can provide clients with custom-feel service despite a challenging commission environment.

Armed with next generation technology, the sales trader of the future can provide clients with custom-feel service despite a challenging commission environment.

Equity commissions fell below expectations, RBC Capital Markets maintains lead on Canadian equity brokers, ITG tops in Canadian Equity Algorithmic Trading.

Lower all-in costs or better terms continues to be the overriding factor for determining the lead manadate for long-term bond offerings.

Risk management - focus on business interruption is considered an extremely high priority by 45% of respondents.

Financial stability (counterparty risk) is the most commonly cited reason why banks are chosen as the lead domestic cash management provider.

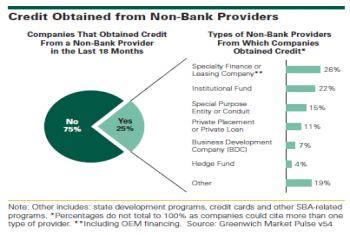

A notable share of U.S. small businesses and middle market companies are obtaining credit from non-bank providers.

Financial stability (counterparty risk) is the most commonly cited reason why banks are chosen as the lead domestic cash management provider.

Respondents kept 66% of average monthly balances on deposit with domestic cash management providers, with their 1st bank.

In U.S. equities the main priority is getting paid for what you deliver. Mid-sized brokers and research specialists that are now being paid in large part through CSAs must be careful that they are being adequately compensated for their research.

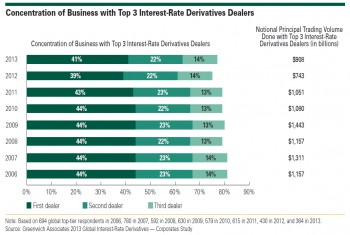

Corporate users continue to concentrate their IRD business among their top three dealers, while asset managers and hedge funds are starting to diversify their lists.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder