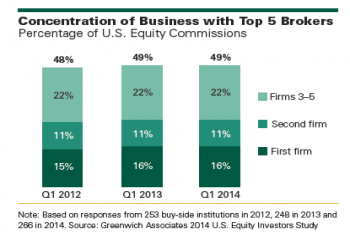

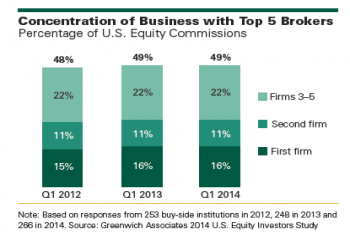

As they pare back on their lists of brokers and providers, most institutions rely on the “broker vote” to determine which firms to keep, and ultimately, how their research and advisory service dollars will be apportioned.

As they pare back on their lists of brokers and providers, most institutions rely on the “broker vote” to determine which firms to keep, and ultimately, how their research and advisory service dollars will be apportioned.

Trading volume declined from last year.

Government bond allocations decline again as fixed income diversification continues.

Among the larger schemes, at least half recognize three or fewer solicitations over the year.

U.K. consultants report strong demand for core real estate but think clients will be slow to move to value-added space.

Compensation levels for financial professions covering Equities in Europe increased slightly.

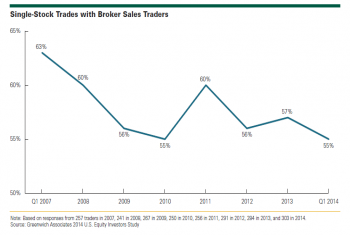

Armed with next generation technology, the sales trader of the future can provide clients with custom-feel service despite a challenging commission environment.

Equity commissions fell below expectations, RBC Capital Markets maintains lead on Canadian equity brokers, ITG tops in Canadian Equity Algorithmic Trading.

Financial stability (counterparty risk) is the most commonly cited reason why banks are chosen as the lead domestic cash management provider.

Lower all-in costs or better terms continues to be the overriding factor for determining the lead manadate for long-term bond offerings.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder