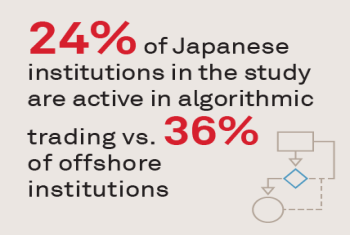

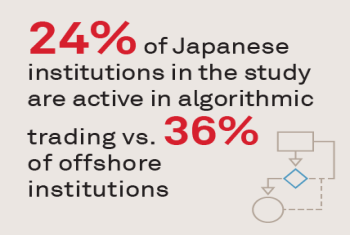

Japanese Equity Trading, a Business of Segregated Niches

In 2022, inflation, rising interest rates and other macroeconomic headwinds replaced pandemic disruptions as the key challenges facing institutional investors in Japanese equity markets.

In 2022, inflation, rising interest rates and other macroeconomic headwinds replaced pandemic disruptions as the key challenges facing institutional investors in Japanese equity markets.

Transaction Banking Revenues reached a decade high in FY22, driven by robust growth in Cash Management, while Trade Finance grew moderately.

See which asset managers are viewed as leaders in the industry according to institutional investors across Europe.

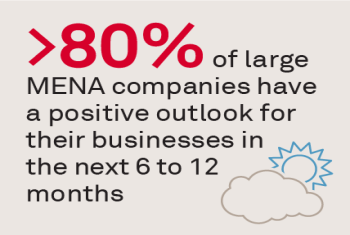

Despite economic headwinds around the world, large companies in the Middle East and North Africa remain extremely positive in their outlook, with attention and resources focused on expanding and diversifying businesses, and growing revenues.

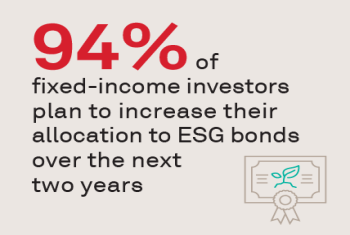

ESG is one of the more ubiquitous topics in asset management, yet inconsistencies around taxonomies, data and regulation means the impact is fluid.

This report contains links to the data tables in excel format for the Canadian Institutional Investor Key Trends.

This report contains links to the data tables in excel format for the U.S. Institutional Investor Key Trends.

Reduced commission rates, constrained budgets and smaller team sizes have left both asset managers and brokers facing greater pressure to automate their trading workflows and accomplish more with less.

Japanese institutions are embarking on an ambitious plan to remake their investment portfolios by significantly expanding allocations to alternative asset classes. That transformation is introducing a new level of complexity that will eventually...

Securities Services Index Revenues expanded in all regions, particularly in Americas and APAC where Net Interest Income grew significantly.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder