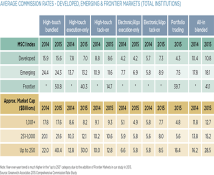

Despite regulatory reforms, volatile markets and debate about potentially radical changes to market structure, “headline” commission rates paid by institutional investors on global equity trades held steady from 2014 to 2015.

Greenwich Associates provides a valuable market data and trend analysis, including accurate benchmarking data on topics such as staffing, use of high-touch versus low-touch execution and payment for research. A centerpiece of our equity research is our annual Comprehensive Commission Rate Study, which provides a thorough look at global commission rates not offered elsewhere in the marketplace.

The Comprehensive Commission Rate Study arms buy-side traders with reliable data with which to benchmark rates against peers and identify discrepancies, and it provides an accurate reporting mechanism for compliance and best-execution committee meetings.

To meet our clients’ ever-growing need for accurate and actionable data, we renewed and expanded on last year’s successful commission rate benchmarking study by nearly doubling the respondent base and expanding the scope of coverage.

MethodologyBetween September and November 2015, Greenwich Associates canvassed heads of equity trading at North American, European and Asian institutions regarding typical commission rates paid across 77 different markets. Desks were asked for their overall bundled rate; execution-only rates for both high-touch and electronic trades; tack-on rates for both high-touch and electronic trades; portfolio trading and all-in blended rates across developed, emerging and frontier markets.