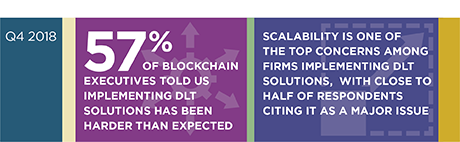

Earlier this year, Greenwich Associates released research looking at the current state of enterprise blockchain adoption in capital markets1. The study found distributed ledger technology (DLT) solutions were steadily moving along the adoption curve, with 14% of companies reporting they had already moved into production. It is fair to say, though, that the industry has lagged behind its own optimistic expectations from two years ago. Implementing enterprise technology designed to replace decades of legacy market infrastructure is no simple task, and 57% of blockchain executives told us it has been harder than expected.

In this latest research paper, we look at some of the key technical challenges executives are facing and analyze their approach to solving them.

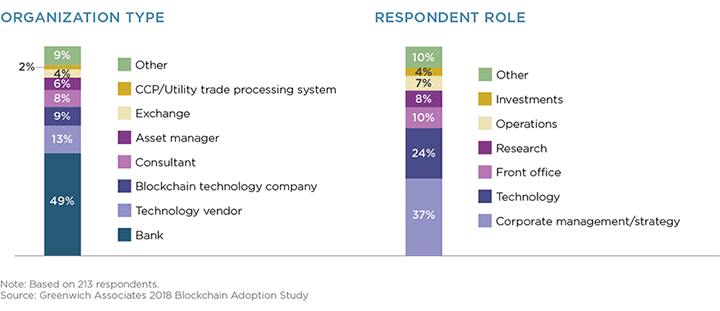

MethodologyDuring February and March 2018, Greenwich Associates interviewed 213 global market participants working on blockchain technology to assess the current state of blockchain adoption in capital markets. Respondents include representatives from a broad array of organization types, 93% of whom are either key decision-makers or actively involved in blockchain initiatives.