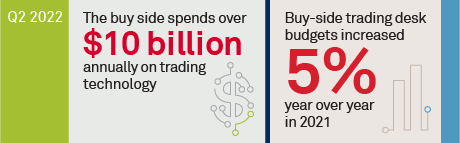

The average buy-side trading desk budget is just over $2 million annually, inclusive of both technology and compensation, with roughly one-third allocated to technology spending. In aggregate, Coalition Greenwich data shows that buy-side firms spend over $10 billion annually on technology.

To put these figures into context, it’s important to understand the demographics of the respondents. Fixed-income trading desks in our study span across both rates and credit markets. Half the fixed-income respondents trade both rates and credit products, while the other half remain focused on a single asset class. In total, 56% of the fixed-income traders trade U.S. corporate bonds, 44% trade U.S. Treasuries, and 44% trade interest-rate derivatives. For equities, the respondents are primarily responsible for cash equity trading, although just under 50% also trade equity derivatives.

MethodologyDuring Q4 2021, Coalition Greenwich interviewed 185 buy-side traders across the Americas and EMEA as a part of the annual Market Structure & Trading Technology Study. Respondents were asked a series of qualitative and quantitative questions focusing on the organization of their trading desk, budgets and the technology tools used.