Investment banking profits are a two-sided coin. Revenues often make the headlines, but it can be reductions in spending that increasingly drive profitability. Ideally, all spending would focus on top-line growth and product development. The reality, however, is that obligatory functions such as risk management, compliance, operations, and other administrative activities contribute significant, hard-to-reduce costs. And given this period of new regulatory proposals and rule implementations, spending on compliance can require deprioritizing new product development or render certain products less financially enticing.

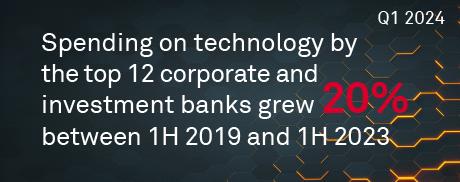

Even still, innovation can’t stop. The last few years have also seen disruptive technologies, including distributed ledger technology, artificial intelligence/machine learning (AI/ML), and cloud computing enter the consciousness of capital markets, forcing banks to have a strategy for these technologies or risk falling behind. How firms react to these and similar changes plays a big role in determining their ability to grow. Investment priorities and budgets reveal that technology spending is increasingly embedded into business growth plans, ensuring that client experience, regulatory compliance, operational efficiency, and profits are all addressed.

MethodologyCoalition Greenwich maintains submission-based normalized proprietary benchmarks. The Coalition Index tracks the performance of the 12 largest Investment Banks globally. It comprises:

- 2018 to 2020: BofA, BARC, BNPP, CITI, CS, DB, GS, HSBC, JPM, MS, SG, UBS

- 2021 to 2023: BofA, BARC, BNPP, CITI, DB, GS, HSBC, JPM, MS, SG, UBS, WFC

The Coalition Index is refreshed for 1Q, 1H, 3QYTD and FY.

The numbers may not add up due to rounding. Percentages are based on unrounded numbers.

Note the Source for the data is Public domain information including financial disclosures, investor presentations, media articles, independent research, and on-going validation by an extensive network of market participants.