The derivatives market in 2024 will focus on increasing efficiency in response to key global and industry drivers that are adding costs and risks to trading desks. At the same time, opportunities for growth are also forcing technology responses that will help manage through the key challenges that participants state will shape the future of the market.

Global headwinds are driving efforts across the industry to become more efficient with how capital is used and how trades are processed. Artificial intelligence (AI) is another hot topic for the industry, but when asked about the potential impact on their own workflows, study respondents expect just as much impact and possibly more from industry-specific trends, such as standardization of operational processes and the use of tokenization in collateral management.

There are overlapping efforts to mitigate the effect of new regulations; the ability to optimize collateral can improve the performance of a trading desk but is also an operational and data challenge that requires investment in new tools. Derivatives are an integral component in the financial and asset management ecosystem, and the potential for increasing volatility shines the spotlight directly on support of these instruments.

This report is based on a study conducted by Coalition Greenwich in partnership with FIA, the leading trade association for the futures, options and centrally cleared derivatives markets. FIA’s membership includes clearing firms, exchanges and other market participants from more than 40 countries.

This research provides a unique perspective into the key drivers for the global derivatives clearing business. The research reveals industry sentiment on several external factors and industry trends that are impacting the health of the clearing industry and the outlook for further growth. Coalition Greenwich and FIA identified three main subsets within the responding institutions: end users, which include asset managers and hedge funds; intermediaries, which include brokers, dealers and clearing firms; and infrastructures, which include exchanges and clearinghouses.

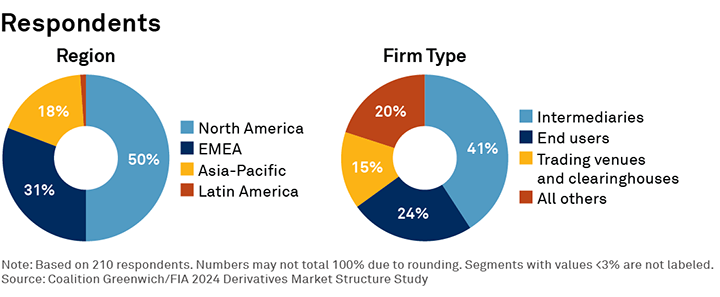

MethodologyThese findings are based on interviews conducted between November and December 2023 with 210 derivatives market participants and experts sourced from the Coalition Greenwich network and the FIA community. The research includes findings from 50 professionals working at asset managers, hedge funds and other end users, and 87 professionals working at clearing firms, brokers, swap dealers, and other intermediaries. Of the remaining 73 professionals from other types of market participants, 31 work at exchanges, clearinghouses and other market infrastructure operators. The majority are focused on exchange-traded derivatives, but many are involved with cleared OTC derivatives such as interest-rate swaps. Half are based in North America, the other half split between Europe and Asia-Pacific. Questions explored the key drivers of change in the derivatives market, strategic priorities, challenges in today’s market, and how firms will respond to regulation and other market drivers going forward.