Executive Summary

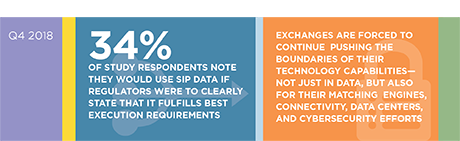

Although, exchanges have improved the latency and reliability of both direct exchange feeds and consolidated feeds, market participants complain about having to subscribe to expensive direct feeds. This Greenwich Associates report looks into usage of direct exchange feeds and their importance to the market.

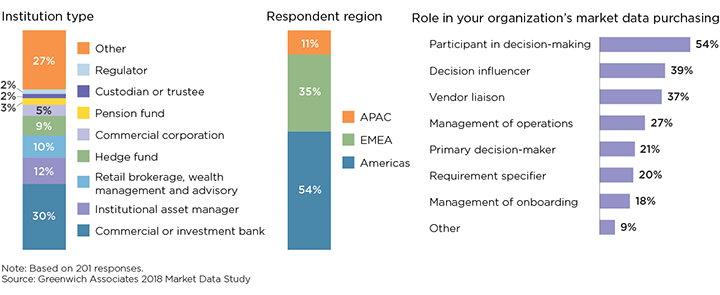

MethodologyIn Q1 2018, Greenwich Associates interviewed 201 market data professionals and users in order to understand their usage of market data products. Data products covered include direct exchange feeds and consolidated feeds.