While few firms were immune to some level of disruption in compliance and trading operations as a result of the market upheaval, a clear pattern can already be detected from early data examined by Greenwich Associates in March 2020.

Consistently, the role of prior proactive surveillance infrastructure investment has emerged as the common denominator in firms that were best equipped to withstand the trial by fire experienced by market participants.

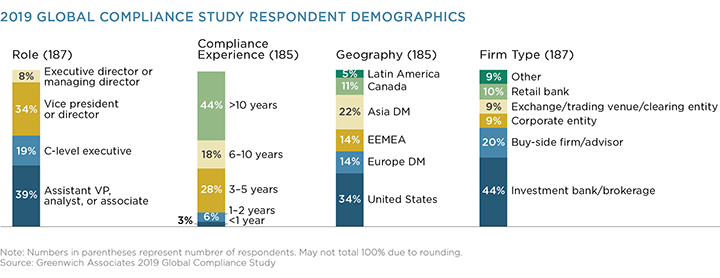

MethodologyThroughout Q2 and Q3 2019, Greenwich Associates interviewed 187 professionals and executives working directly in compliance roles for the 2019 Global Compliance Study, executed in partnership with Nasdaq. Interviewees were highly experienced, with 61% working at a director or executive level, representing broker-dealers, buy-side firms, corporate entities, retail banks, and market infrastructure entities. Global distribution of respondents was wide, with the largest share of responses (34%) coming from the United States, followed by EMEA (28%), Asia (22%), and other geographies.

Proprietary analysis of the 2019 Global Compliance Study results was completed by Greenwich Associates. Historical study results dating back to 2015 were provided by Nasdaq and were used by Greenwich Associates to interpret trends over time, as the distribution of participant demographics have remained consistent. Where applicable, statistical significance testing was conducted by Greenwich Associates; statistically significant conclusions indicate that the selected responses lay outside of two standard deviations from the mean when tested at the 95% confidence level.