Controlling risk has been a central theme for banks since the financial crisis of 2008. During that time, U.S. regulators addressed issues concerning practices tied to market making, derivatives exposure, counterparty risk, and more. Likewise, the Basel Committee for Banking Supervision (BCBS) put forth several modifications to its Basel 2.5 framework in response to the global credit crisis. The resulting Basel III regulation included the Fundamental Review of the Trading Book (FRTB) rules, placing new market-risk requirements on banks.

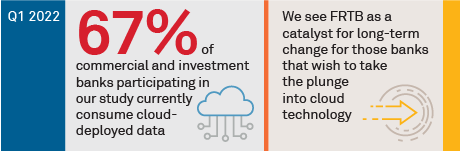

The introduction of FRTB coupled with the onset of the COVID-19 pandemic has created a unique opportunity for banks to rethink their architecture and risk management process—a dynamic that will influence competitiveness in the next few years. As a result, growing interest in the cloud is becoming an important part of this transformation. The perfect storm of decentralized working conditions and the rigorous computational demands of the rules has risk teams rethinking legacy systems and on-premise deployments to keep up with an evolving regulatory and work-culture environment.

MethodologyDuring Q2 2021, Coalition Greenwich conducted numerous conversations with global market participants and technology providers about risk management, the use of cloud and related topics.