Table of Contents

The technology investments wealth management firms make today will play a big role in determining their ability to support financial advisors in their efforts to win clients and retain assets in the future. As such, technology needs, capabilities and costs are now, and will continue to be, at the center of nearly every strategic decision wealth management firms make.

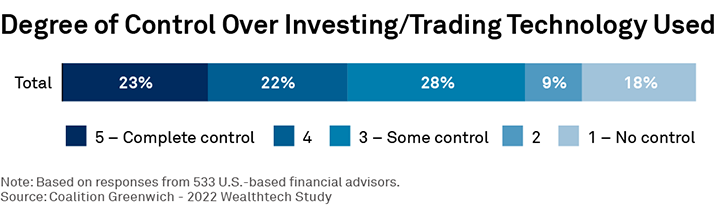

U.S. households had $107 trillion in financial assets as of Q3 2022,1 all of which could, at least in theory, be managed by professional advisors. Given those stakes, it’s imperative that wealth management firms allocate their technology budgets with only return on investment in mind. And with 73% of advisors in our study having either some or complete control over the technology they use, financial advisors are clearly in the driver’s seat.

Our findings reveal an industry that is still working to define the ideal technology infrastructure—what drives client acquisition, what helps investment performance, and what is simply cool versus actually impactful? “Wealthtech” providers, with input from the advisors that ultimately put this technology to work, must, in turn, understand the optimal advisor workflow that should be the focus of their development resources.

Wealthtech Investment Priorities

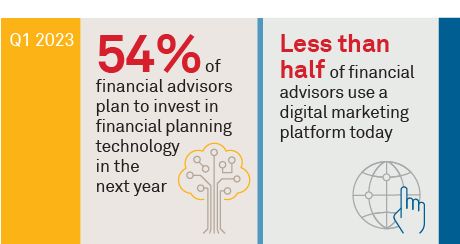

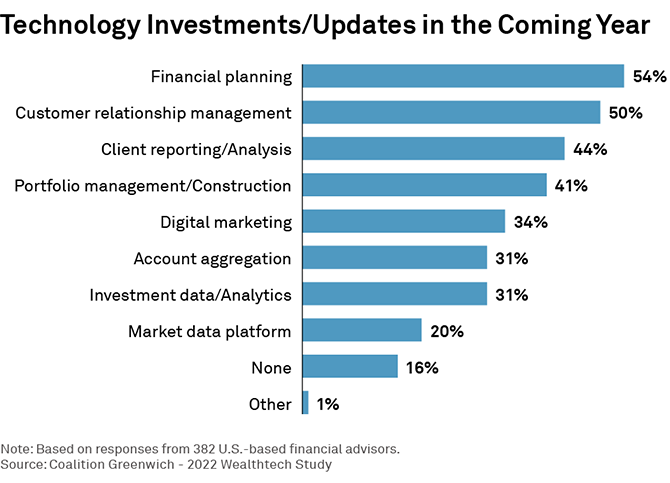

Wealth management firms and the financial advisors that work for them understand the growing importance of digital capabilities, and they have ambitious plans for technology investment and development in the coming year. More than half of the financial advisors participating in our study expect to invest in financial planning technology in the next 12 months, and almost as many plan to upgrade their customer relationship management (CRM) platforms.

This makes sense: high-touch financial advisors add and maintain clients based on their ability to gain trust and grow those relationships over time. With the average financial advisor servicing 100+ clients, it is imperative that they employ a technology-enabled service model. As such, investing in technology to support those functions should, in time, provide advisors with much-needed scale.

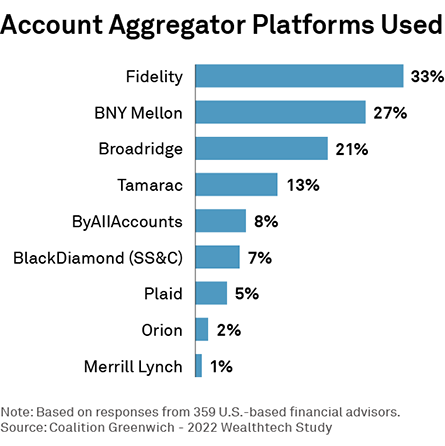

Other expected technology investments also follow this theme. Client reporting, portfolio construction and digital marketing are all about providing the best advice and growing client relationships through technology. Even account aggregation, which allows clients to see balances at other institutions, can keep clients loyal. An advisor that owns the client’s view into their investments is more likely to see the balances held elsewhere migrate into their ecosystem over time.

Turnkey Asset Management Platforms (TAMPs)

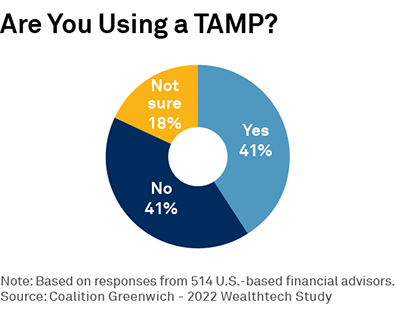

For many, a TAMP acts as the foundation of their technology strategy. Among financial advisors with an understanding of their organization’s technology stack, about half say their firm uses a TAMP. Our data further shows that TAMPs are most often used by independent RIAs (64%) and advisors at insurance firms (67%). Those at wirehouses are less likely to use a TAMP, often looking instead to internally developed technology.

The fact that nearly one-fifth of respondents didn’t know if they were using a TAMP isn’t surprising. Our analysis of technology usage in both retail and institutional financial markets has consistently shown that it is often unclear to end users how the platforms they use are categorized. Such labels can be viewed as merely marketing tools, with access to critical functions the only thing that matters to advisors and traders day to day.

Keeping with industry standard definitions, for this research, we define TAMPs as digital platforms that provide financial advisors with the tools they need to manage the portfolios of and relationships with their clients. Although the third-party platforms commonly referred to as TAMPs vary considerably in terms of features and functions, TAMPs commonly support workflows such as portfolio management, client onboarding, compliance, tax optimization, and client reporting.

TAMPs are designed for flexibility, allowing clients to select many workflow solutions on an a la carte basis in order to build a customized platform with the functionality they require. Using APIs and increasingly via cloud deployment, TAMPs are also built to (theoretically) integrate easily into wealth managers’ existing systems and to interact with other third-party technology systems. Integration of various functions is critical, as wealth managers already use an incredibly wide range of technology solutions for business functions such as financial planning and portfolio management, whether built in-house or from a third party.

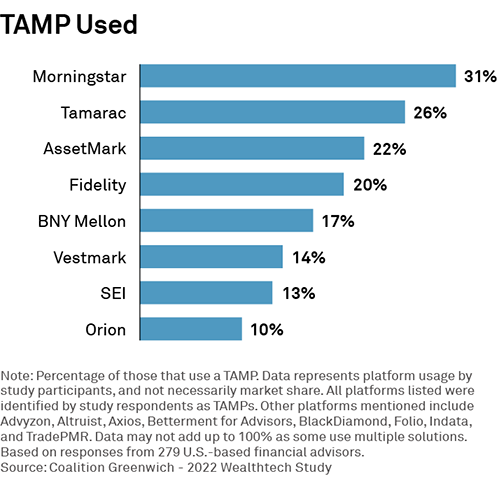

Both financial services (e.g., BNY Mellon Pershing, Fidelity) and fintech firms have TAMP or TAMP-like solutions. Morningstar, Envestnet’s Tamarac and AssetMark were the most-used third-party solutions by our study participants. Other popular fintech TAMPs include Orion, SEI and Vestmark.

Data and Analytics

While investment in market data systems was low on the list of technology investments for 2023, their importance to financial advisors should not be understated. The accuracy of market data and investment data is absolutely critical to the success of any financial advisor. Even the best portfolio construction tools or financial planning systems are of little use if they don’t have access to the right data—garbage in, garbage out.

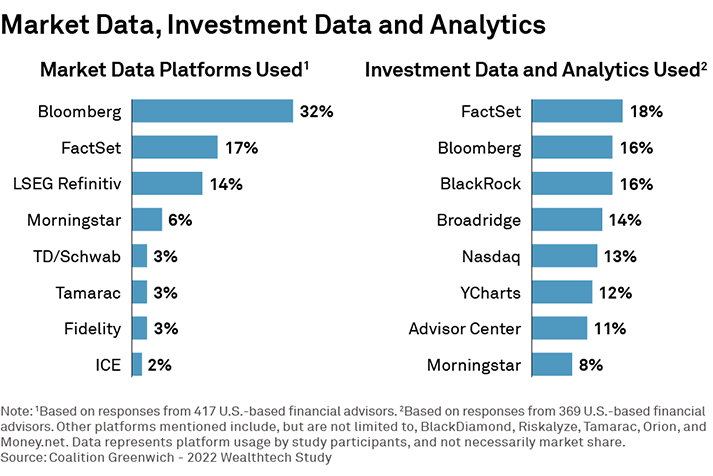

As such, wealth management firms have already invested heavily in this area, limiting the additional investments needed today. Further, the billions of dollars poured into innovation by the world’s largest data providers ultimately benefit the users of those platforms. Bloomberg, FactSet, LSEG’s Refinitiv, and Morningstar are collectively used by more than half of our study participants for market data and largely dominate the landscape.

The mix of firms used for investment data and analytics is similar, and also includes household names like BlackRock, Broadridge, and Nasdaq, among others. YCharts also stands out, given its place among these industry giants. The competition among these firms, bolstered by the quick advancements of startups, broker-provided offerings and others, ensures that advisors continue to see better access to better data and analytics year after year.

It is important to note how data from these providers is used and financial advisor perceptions of where that data comes from vary greatly. For instance, while the Bloomberg Terminal is nearly ubiquitous on institutional trading desks, financial advisors are more apt to consume data from Bloomberg.com (the news division). Similarly, Morningstar’s fund research is a near necessity for most U.S. advisors, although methods of accessing that research and data varies. And lastly, LSEG Refinitiv products, research and data (some under the legacy Thomson brand) are also heavily used by advisors, but can be accessed through other front-ends (for instance, a TAMP or firm-specific platform). As such, our research results on data usage should not be viewed as market share but, instead, advisor perception of where they get their market data and analytics.

Data and the analytics that put that data to use act as the foundation for nearly everything a financial advisor does. Data and analytics are remaking the way advisors prospect, identify client needs and preferences, provide advice, build portfolios, and report and communicate to clients. High-powered analytics are already the key to creating personalized investment and service strategies at scale across a portfolio of clients. Going forward, predictive analytics (aka artificial intelligence) will have an even bigger impact, making wealth managers vastly more efficient and effective at serving their clients.

Marketing and Social Media

Less than half of the advisors in our study are using a digital marketing platform. At a time when nearly three-quarters of U.S. consumers are using social media sites like Facebook, Twitter, Instagram, and TikTok,2 wealth managers who are slow to deploy digital marketing and social media strategies could quickly find themselves at a disadvantage in the competition for clients, especially when it comes to younger investors. And as the generational wealth transfer from baby boomers to millennials continues, millennials and Gen Z will often look for new advisors—and advisors need to meet them where they are.

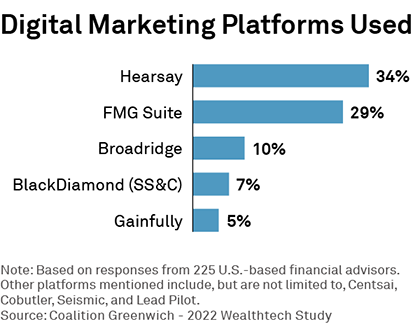

To that end, one-third of financial advisors say they or their firms are planning to invest in a digital marketing platform in the coming year. These advisors are looking to tap into the ability of third-party platforms to execute social media campaigns and other digital marketing strategies using personalized content to drive engagement. Among current users, the most-used digital marketing platforms by our study participants include Hearsay, FMG Suite and Broadridge.

The Right Technology and the Right People

Wealthtech is not poised to replace high-touch financial advisors as many feared (or hoped) but, instead, is set to enhance their ability to serve more clients with a higher level of service than ever before. Choosing where to invest in technology that will bring the biggest return on investment is no small feat. And even when technology needs are clear, many smaller RIAs don’t have the resources to work through what is often a long-term implementation process.

Thankfully wealthtech deployment no longer requires big, onsite installations of software, with cloud-based tools increasingly the norm. And whereas a decade ago, the best solutions were reserved for those willing and able to build in-house, the third-party solutions available today are as good or, in some cases, better. Lastly, the integration of multiple systems and data sources no longer brings the headaches it once did, with customized workflows increasingly obtainable and affordable.

Providing financial advice remains a people business, but the right technology can make the right people better.

Dan Connell, Kevin McPartland, David Easthope, Kevin Trimble, and Brad Tingley advise on market structure and technology globally.

1https://www.federalreserve.gov/releases/z1/dataviz/z1/balance_sheet/chart/#series:financial-assets

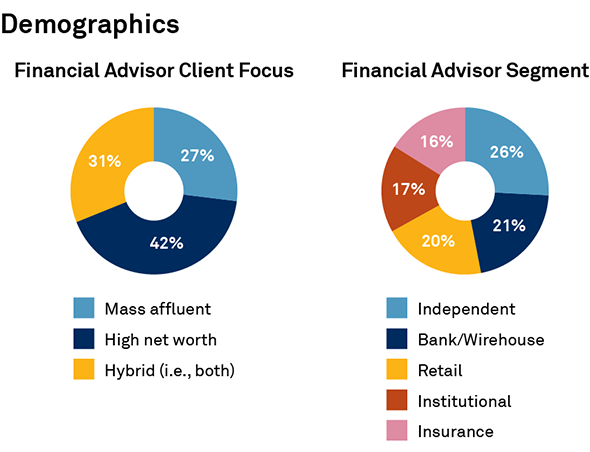

MethodologyIn the second half of 2022, Coalition Greenwich conducted a study designed to examine technology usage and priorities among U.S. wealth managers. The study is based on input from more than 500 financial advisors representing banks, wirehouses, insurance companies, RIAs, and institutional investment firms.