Allocations to exchange-traded funds by institutions currently investing in ETFs increased to 18% of total assets in 2018, up from 13% in 2017, among the 50 institutional ETF investors participating in the most recent Latin American Exchange-Traded Funds Study from Greenwich Associates. That growth was driven by several influential trends, including:

- Shift to a risk-management focus: As they reposition portfolios for what they see as mounting market and geopolitical risk, Latin American institutions are increasing their use of ETFs, which are proving highly versatile tools for implementing specific changes.

- Indexation: Like their counterparts in the United States, Europe and Asia, Latin American institutions continue to move assets from active management to index strategies. With 88% of study participants naming ETFs as their preferred wrapper for index exposures, this transition of portfolio assets remains one of the biggest and most consistent sources of ETF demand.

- Strategic Exposures: Even as they stepped up their use of ETFs in tactical portfolio adjustments related to volatility and other market conditions, Latin American institutions continued adopting ETFs for strategic purposes such as obtaining fixed-income exposures, international diversification and tax efficiency—with the last achieved through the use of European UCITS.

- Appetite for Smart Beta: ETFs have also emerged as institutions’ vehicle of choice for smart beta strategies. Sustained appetite for factor-based approaches could actually accelerate demand for ETFs in 2019. More than 60% of current investors in smart beta ETFs plan to increase allocations to the funds in the coming year.

As these and other developments make ETFs more mainstream components of institutional portfolios, Latin American institutions are applying the funds to a growing list of applications across asset classes. This proliferation of uses is fueling fast expansion—especially in equity portfolios, where half of current ETF investors are planning to expand allocations in 2019, with many of these institutions anticipating increases in excess of 10%.

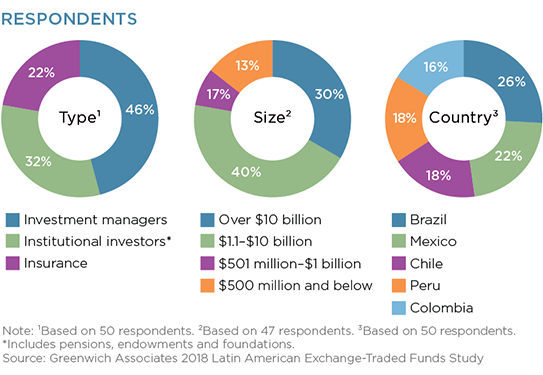

MethodologyBetween October and December 2018, Greenwich Associates interviewed 50 institutional investors for its third annual edition of the Latin American Exchange-Traded Funds Study. The research universe included 23 asset managers, 16 institutional funds and 11 insurance companies/insurance company asset managers.

Most of the participants are large institutions. Almost 45% of the institutions in the study have assets under management (AUM) of more than $5 billion, and more than 70% manage in excess of $1 billion.

The research universe included 27 portfolio managers/chief investment officers, 14 research analysts, and seven traders.