Benchmarks play a vital role in every step of the investment process, for both active and passive investors.

An overwhelming proportion of investors agree that they are an important part of their business. However, many asset managers feel they do not offer good value for money.

This research paper discusses perceptions of index providers and identifies opportunities where they can step up and increase the value provided across the enterprise. With their abundance of data and analytical expertise, indexing companies should consider strategies that can enhance their clients’ research and marketing activities.

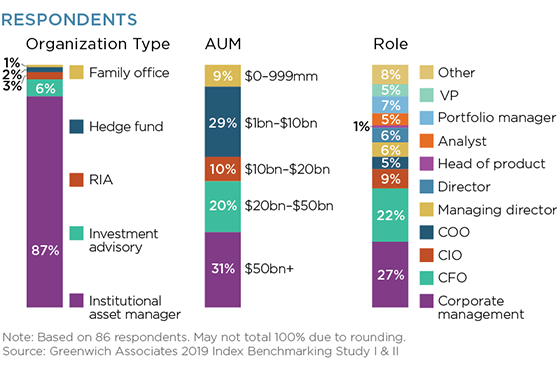

MethodologyThe data in this report is sourced from two separate studies conducted by Greenwich Associates over the last year. Between August and November 2018, Greenwich Associates interviewed 42 executives at asset management companies in North America with the role of CFO or other finance management positions. Between February and April 2019 we interviewed 44 executives within active investment teams. Respondents in both studies were asked quantitative and qualitative questions about trends in their industry related to costs and revenue, as well as specific questions about usage of benchmark index data. This independent research was commissioned by FTSE Russell. The analysis and conclusions expressed in the paper are the result of independent analysis by Greenwich Associates.