Table of Contents

Executive Summary

This Greenwich Report provides a unique perspective into the key drivers for the derivatives clearing business. Responses from market participants, gathered by Coalition Greenwich and FIA in the fall of 2021, reveal industry sentiment on several external factors that are impacting the health of the clearing industry, notably:

- Changes in market structure

- The emergence of new market

- The implementation of new regulatory requirement

The research also identifies the internal steps that clearing firms are taking to gain competitive advantage, enhance their services and tap into new opportunities for growth.

This report is based on a study conducted by Coalition Greenwich in the fall of 2021 in partnership with FIA, the leading trade association for the futures, options and centrally cleared derivatives markets. FIA’s membership includes clearing firms, exchanges, and other market participants from more than 40 countries.

Increasing Demand for Clearing Products and Services

The overall mix of derivatives (exchange-traded, cleared over-the-counter (OTC) and uncleared OTC) traded by end customers—asset managers and hedge funds—changed in notable ways over the past 12 months. Buy side use of exchange-traded derivatives (ETD) was essentially stable over that period, which may seem surprising, given reports of record volume on several major exchanges. But those increases were driven mainly by increased retail participation, especially in equity options, and the introduction of “micro” contracts that have little appeal for institutional investors. Those trends had little effect on the trading of contracts favored by asset managers and hedge funds, such as interest-rate futures.

In contrast, the use of cleared OTC derivatives has risen dramatically. On the rates front, our data shows that buy-side use of cleared interest-rate swaps (IRS) and cleared inflation swaps increased by 52% and 58%, respectively. Conversely, uncleared IRS showed a significant decrease in usage, with 35% of buy-side respondents reducing their use of the instrument, while uncleared inflation swap usage dropped 33%.

The credit market showed similar trends—decreases in uncleared single-name and index credit-default swaps (CDS) and rises in cleared single-name and index CDS. Given the continued phasing-in of uncleared margin rules (UMR) and buy-side desire to reduce counterparty risk, this shift was expected and will continue. Across all asset classes, 43% of respondents expect liquidity in uncleared swaps to decrease. That volume will not disappear but migrate to cleared swaps, futures and options.

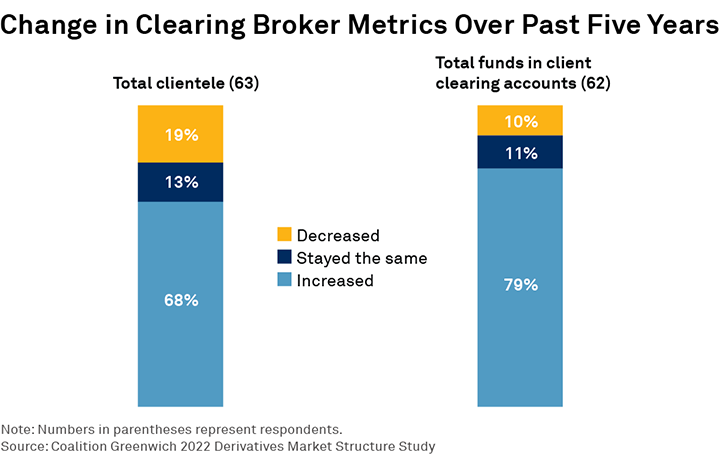

Not only are volumes and appetite growing, customer fund balances—another key metric for the health of the clearing business—appear to be heading in a positive direction. Seventy-nine percent of clearing brokers saw an increase in customer fund balances over the past five years, while only 10% saw a decrease. In addition, 68% increased their total client count, while less than 20% saw the business shrink.

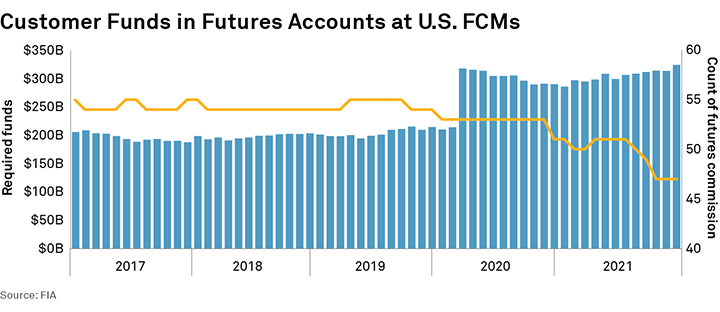

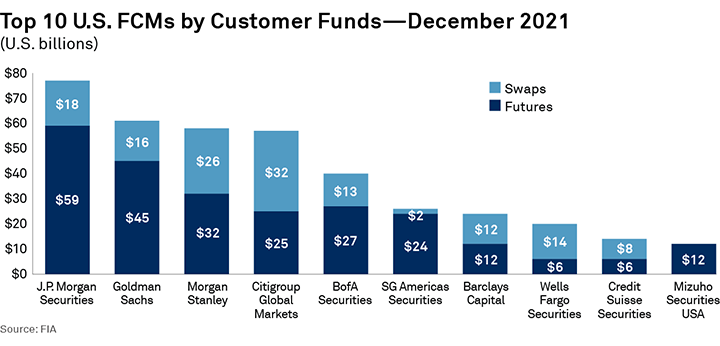

Data published by the Commodity Futures Trading Commission (CFTC) confirm this finding. CFTC monthly reports on customer fund amounts show that customer fund balances in futures accounts hit an all-time record of $324.5 billion in December 2021, up 11.8% from the prior year. Meanwhile, customer funds held in cleared swaps accounts at U.S. futures commission merchants (FCMs) reached $146.1 billion in December 2021, up 23% from December 2019.

This upward trend was only partly due to greater use of derivatives. The primary driver was a step-change in margin requirements that clearinghouses implemented in March 2020, when the impact of COVID-19 on the global economy triggered a massive increase in volatility. Clearinghouse margin models are designed to increase the margin required on cleared derivatives when volatility rises, in order to cover the increased risk of loss. A recent report published by BIS found that the amount of collateral held to meet initial margin requirements for ETDs increased by approximately $200 billion, or 62%, between the end of February and the middle of March 2020. The report also found that increases in the margin requirements set by clearinghouses, rather than changes in positions, were the main driver for this increase.1

Since then, initial margin requirements have remained higher than pre-COVID, but there has been no decrease in customer funds—at least not at U.S. FCMs. In other words, customers opted to meet the margin calls and retain their positions, rather than unwind their positions and reduce their balances. This reinforces the importance of these products and the fact that customers, though never eager to post margin, are willing to do so.

The outlook for clearing services remains strong, as the industry continues to follow the emergence of derivatives on new asset classes and the ongoing growth of clearing. Three areas of potential growth in ETDs are China, carbon and crypto (digital assets). Our data shows that while only a small number of participants are currently active in these markets, many are watching with interest.

Digital Assets

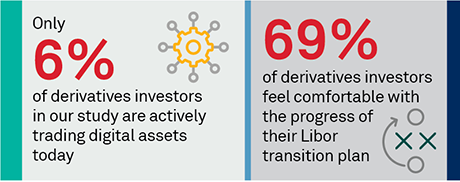

Over the last four years, a small but growing number of exchanges have introduced futures and options on cryptocurrencies such as bitcoin. Our research shows that these new contracts are more important to our sell-side respondents than to the buy side, with 43% of the sell side currently active in the market and planning to increase that activity, compared to only 6% on the buy side. The buy side remains hesitant, as more than 50% are not interested at all and 33% are not ready to commit to this emerging asset class. For many on the buy side, their mandate will not allow them to trade crypto; others view the volatility of the asset as an issue. For those on the buy side that are active in crypto futures, diversification is the major motivation for trading these products. Of course, products such as futures on Bitcoin and Ethereum attract a lot of attention and deserve close monitoring as client perceptions change over time.

Only 10% on the sell side consider digital assets irrelevant, but a majority are in a wait-and-see mode. There are a variety of obstacles, such as regulatory uncertainty, volatility of the asset and KYC/AML requirements. Newer entrants that are crypto-native have begun to enter this space, offering a variety of services for derivatives, such as trading, custody, lending, and risk management strategies. The long-term prospects of digital assets and their derivatives are not certain, but we expect that additional regulatory clarity in the coming years, coupled with continued efforts by banks and brokers to provide clients with new services, will drive buy-side demand going forward.

China

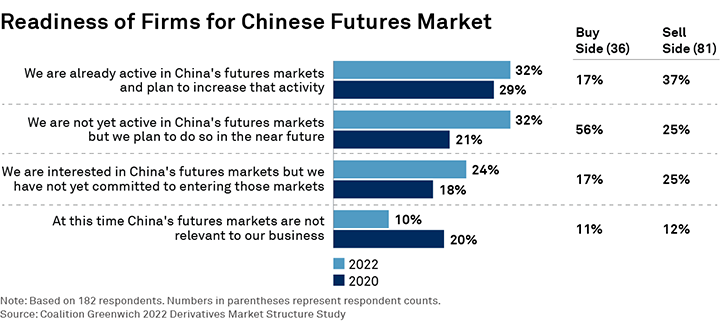

In recent years, the Chinese authorities have moved slowly but steadily to open their futures markets to the outside world. China’s commodity futures markets rank among the largest in the world in terms of trading volume, and its equity and bond futures markets are developing rapidly. These trends intrigue trading desks, but some trepidation remains.

Nearly two-thirds of respondents are either already active in China’s futures market or plan to be in the near future, up from only half two years ago. Similar to crypto, the buy side is less enthusiastic than the sell side about the opportunities in China, with 56% of the buy side classifying China as irrelevant. Even on the sell side, only 37% are active, meaning that those buy-side respondents that do want to trade in this market will have fewer counterparties to choose from. However, there are offshore solutions for access to China, such as the SGX FTSE A50 futures. It’s worth noting that our study participants are primarily in the U.S. and Europe, which may have impacted perceived interest in accessing the onshore markets.

Carbon

The carbon markets—which are part of the broader climate and ESG trend—have, thus far, been developed primarily in Europe, under the EU ETS. The sell side, as in the other emerging trends, is farther along in its adoption, with 42% being active compared to 11% on the buy side.

A high proportion of the buy side does not consider the carbon futures markets directly relevant to their business. For many portfolio managers, trading futures based on ESG indices may be a more effective way to manage the impact of climate risk on their investment portfolios. On the other hand, there has been a surge of interest in carbon offsets since the COP26 climate conference, and interest in futures on these instruments seems likely to pick up rapidly.

To some extent, the sell side views carbon as another asset to trade in support of corporate and asset manager clients. There are natural end users, such as energy companies, that need to offset their emissions. There is also a push for “net zero” carbon impact, which can be enabled via a carbon-trading strategy. Carbon products also exist in other forms, such as ETFs. In general, the sell side is thinking about climate services more broadly—they want to help facilitate their clients’ transition to climate-risk management.

The View from the Buy Side

Hedging was a primary reason for derivatives usage for 80% of the buy-side firms in our study. When the same question was asked between late 2019 and pre-pandemic 2020, only 57% cited hedging as the primary purpose. This is a significant jump that is due to the massive uncertainty and periodic volatility that started in March 2020 and continues to this day. Another significant change occurred in the use of derivatives for asset liability management, which saw a sharp increase from 23% in our prior research to 50% this year. Only 25% used derivatives primarily for alpha generation.

Regarding market reform issues, the buy side has been focused on the shorter-term impacts of the Libor replacement and UMR. On the Libor front, most of the buy-side respondents feel prepared for the transition—69% have a plan and are comfortable with their progress to date. In our prior research, only 21% felt prepared, indicating how much progress had been made in the 18 months leading up to the end-of-year 2021 deadline. Two-thirds of the buy side still see Libor’s replacement as an issue, primarily because of uncertainty around a new reference rate rather than any lack of infrastructure. Trading in alternative rates has been inconsistent across jurisdictions so far.

Lastly, UMR will, in most cases, increase the amount of margin posted by the buy side for uncleared swaps. In addition, UMR’s rules make the process more operationally complex. For example, there is a new method to calculate initial margin (IM) that requires new data and tools. The increase in required margin, coupled with new operational complexity, will drive more volumes to clearing, but not without speed bumps along the way.

Relationship Management

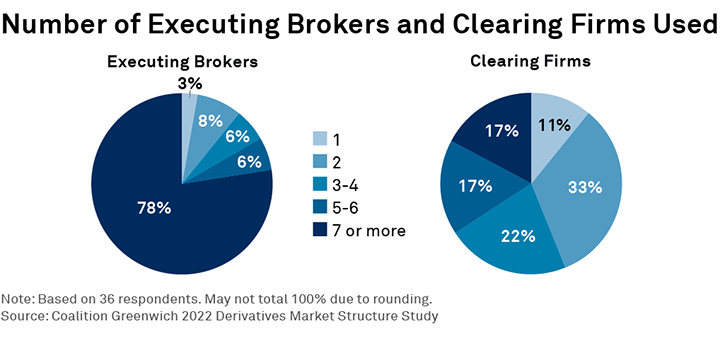

The buy side needs an ecosystem of executing and clearing brokers to support their derivatives activity. Many factors determine how this is constructed—how global the brokers are, the number of asset classes they trade and their views on diversifying or consolidating providers, to name a few. Almost 80% of the buy side use seven or more brokers to execute their trades, and a scant few use two or fewer. The costs of carrying multiple executing brokers is not an impediment, as different brokers may specialize in different markets or provide alternative sources of liquidity. We don’t expect further consolidation in the number of executing brokers used. If anything, we will see the opposite, as the aforementioned new growth areas drive investors to look for new trading counterparties.

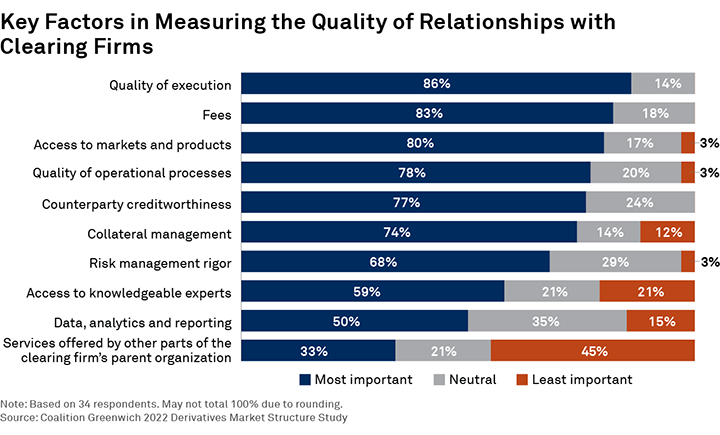

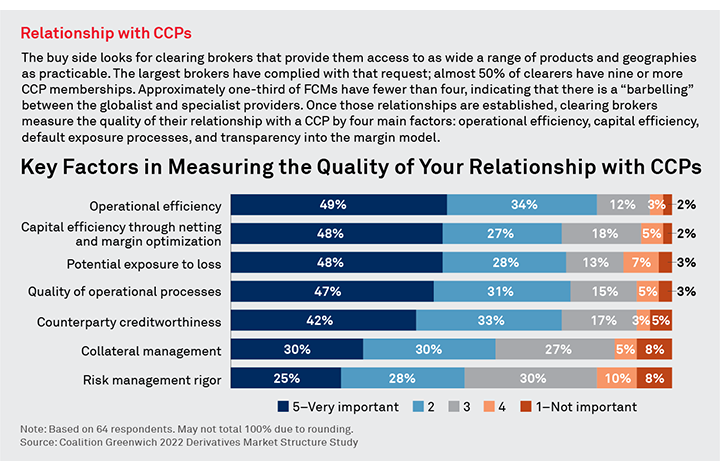

The study also revealed insights on the key factors driving buy-side views on the quality of their relationships with clearing firms. Execution naturally ranked at the top of the list, followed closely by fees. It is telling that the “quality of operational processes” ranked almost as high as “access to markets.” Delivering efficient and timely processing of trades has always been important, but ever since the COVID-19 crisis exposed bottlenecks in certain parts of the post-trade process, the buy side has stepped up its focus on this area.

Conversely, the clearing relationship is much more concentrated. While 89% of respondents have more than one clearing relationship, all work to find the right balance between provider diversification to manage counterparty risk and consolidation for greater margin offsets and more streamlined operations. That said, the most complex buy-side firms will have a greater number of providers—17% utilize seven or more clearing brokers. For them, the increase in operational complexity is required to manage their risk exposure, which often spans dozens of markets and products across even more fund portfolios all over the world.

The View from the Sell Side

In order to maintain healthy margins while still providing the best customer experience, the sell side plans to focus on capital and technology. The regulatory environment, including Basel and SA-CCR, has placed a spotlight on capital management at the large dealers. Given that capital is a valuable (and sometime scarce) resource, sell-side trading and client-management behavior will change to comply with firm directives on capital management. Noting these issues, the technology sector is responding with tools to help optimize and allocate capital in order to help the sell side’s balance sheet, such as margin analytics and portfolio compression.

To that end, managing technology change is the second most important issue for the sell side. Client expectations for what their providers deliver and how they deliver it is constantly rising, and the sell side needs to invest in technology to meet this demand. Further adoption of cloud computing and cloud-delivered solutions acts as an important example.

Data storage and complex calculations were initial cloud use cases for derivatives markets, but the past several years have demonstrated that the opportunity is much greater. Google’s investment in CME, coupled with CME’s commitment to begin moving its infrastructure to Google Cloud, should be viewed as a fundamental shift in how market infrastructure will be built and deployed going forward. Brokers are also investing heavily in cloud-deployed solutions, all part of a technology arms race to both build innovative solutions and partner with exciting fintech firms to better service customers going forward.

Areas of Continued Investment

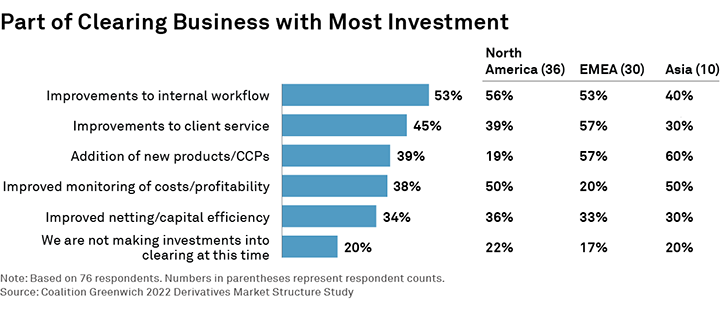

The industry expects to see growth in both currently cleared products and those new to clearing. As the cleared derivatives industry changes, investment will be focused on areas that support this growth. The sell side’s primary focus will be on improving internal workflows. This focus will allow firms to better accommodate increasing volumes, keep costs down and more efficiently manage the entire pre-to-post-trade workflow.

There are some noteworthy geographic differences in priority. In North America, the second priority is improved monitoring of costs/profitability. In EMEA, there is more focus on new products and service improvements, and in APAC, on new products. European market structure will change as the industry responds to the disruptions caused by Brexit, as well as mergers such as Euronext and Borsa Italia, and the growing importance of ESG in European asset management. The continued opening of the Chinese market is likely driving the focus on new products in APAC.

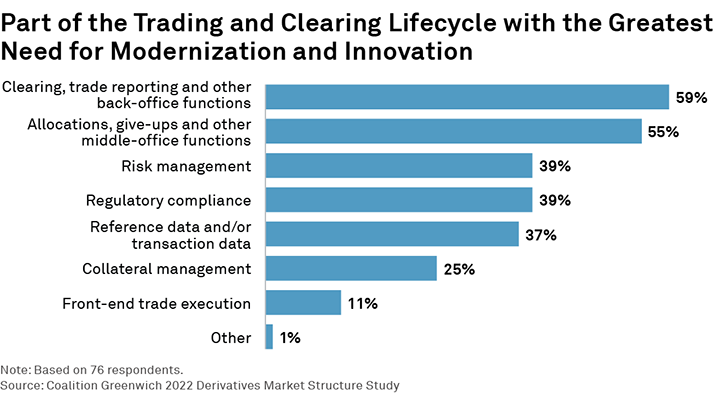

When looking at the entire trading and clearing life cycle, core operational functions dominate the areas in need of modernization and investment. There are a multitude of systems and operational units that shepherd trades as they flow from asset manager to broker to CCP. Each institution in that chain is looking for updated details to feed compliance, risk, margin, and other such systems and processes. Integrating relevant data at each phase of a trade requires automation and a focus on efficiently connecting counterparties and systems.

The Impact of Rising Rates on the Derivatives Market

Nearly all study respondents indicated that interest-rate derivatives are important to their firms, highlighting the central role of these products in the health of the clearing business. Until recently, volatility in this segment of the markets was muted because of the influence of central bank policies. That began to change toward the end of 2021, when the Federal Reserve signaled a shift to higher interest rates to combat inflation. As of early 2022, the Fed funds futures market was pricing in expectations for five interest-rate hikes in 2022, and some analysts are predicting even more hikes in 2023.

The Fed pivot has sparked a surge in trading activity in interest-rate futures and swaps, as market participants have adjusted their positions. Although this surge in trading activity came after the study was completed, it is likely to intensify some of the trends revealed in the data.

- First, the shift in interest-rate expectations is likely to be positive for the clearing business because the need for hedging by the buy side will increase volumes, given uncertainty around short-term rate hikes and longer-term bond rates.

- Second, this trend will intensify the search for capital optimization and the analytics to determine most capital-efficient use of derivatives. Determining the optimal choice of instrument—cleared swaps vs. futures—and central counterparty will drive new technology investment, assuming the right type of crossmargining opportunities.

- Third, the buy side’s interest in the Libor transition will be even more front and center, as the wave of repositioning and hedging comes into the new generation of alternative reference-rate products. The performance of SOFR in particular will be a key factor. It differs from Libor in at least one important respect—it is based on a secured rather than unsecured rate, so it may introduce some basis risk for institutions looking to hedge interest-rate risk in loan portfolios.

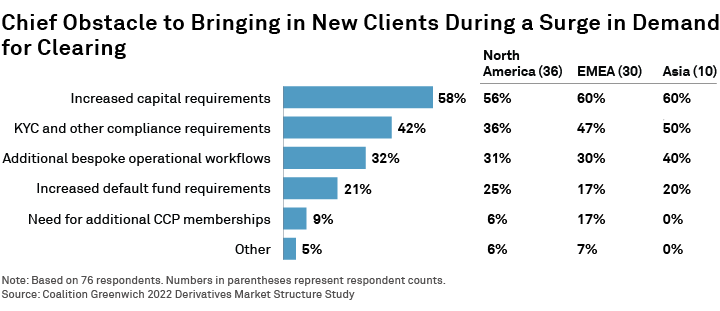

This alignment augurs well for the clearing industry, but there could be a cap on growth. Should there be a significant surge in demand for clearing services, brokers cite capital requirements as an obstacle to accommodating that demand.

This result is further evidence that the sell-side focus on managing their capital will be a top concern over the next few years and will be a key part of the clearing broker and CCP relationship.

There is another type of constraint on the industry—talent. Firms may struggle to find and onboard top talent at the same time their business is growing rapidly and the clearing environment is becoming more complex. The response must, in part, be to identify those operational challenges mentioned above and resolve them. Clearing requires scale; that scale can only be achieved via automation and operational efficiency.

Conclusion

The derivatives industry is braced for change spurred on by a wide variety of factors, ranging from regulation (as always) to technology to emerging asset classes. In order to best position themselves for this change, firms must understand where the market is, where it is headed and why. Clearing is growing, and with that growth comes challenges in capital optimization, operations, product development, and client management. Managing those issues successfully will allow firms the opportunity to gain competitive advantage, enhance services and grow this vital business.

Stephen Bruel heads up the derivatives and FX practice on the Market Structure and Technology team.

1https://www.bis.org/bcbs/publ/d526.pdf

MethodologyThis report is based on data and insights collected from 182 global derivatives market participants between October and December 2021. Respondents include asset managers, hedge funds, broker-dealers, clearing firms, proprietary trading firms, exchanges, clearinghouses, and other industry participants. Questions focused on their habits, opinions and expectations for the global derivatives markets in the next three to five years. Coalition Greenwich collaborated with FIA to both develop the questionnaire and gather responses from industry participants.