Table of Contents

The African continent is poised to experience a significant surge in financing needs over the next five years, driven by substantial infrastructure requirements and sizeable debt refinancing obligations. Annual infrastructure funding needs are estimated to range between $130–170 billion, far exceeding the current investment of approximately $80 billion and leaving an annual financing gap of $50–90 billion.

Concurrently, external debt service obligations are escalating, with African nations expected to pay $88.7 billion in 2025 alone. In response to constrained access to traditional Eurobond markets, African borrowers are increasingly turning to alternative financing channels, presenting a substantial revenue opportunity for global and regional banks that can provide innovative solutions.

Evolving financing channels in Africa

The constrained traditional bond markets have led African sovereigns and corporations to explore unorthodox financing routes, often in collaboration with global and regional banks. Key channels include total return swaps (TRS), syndicated loans, structured derivatives, and selective Eurobond market re-openings. Each of these routes offers distinct structures and revenue implications for banks:

- TRS and synthetic financing: TRS have emerged as a creative tool for sovereign financing in Africa, exemplified by Angola’s $1 billion one-year TRS deal with JPMorgan. This bespoke financing solution allows banks to charge above-market interest rates, resulting in lucrative revenue. Such loans often come at a 150–200 basis point (bps) premium over equivalent Eurobonds yields. This premium is extra interest earnings annually for the bank, on top of arrangement/structuring fees. TRS-based financing could grow to a ~$3–5 billion annual market in 3-4 years, translating into $80–100 million in fee and carry revenues for participating banks each year.

- Syndicated loans and private credit facilities: The African sovereign loan market has been active, with banks providing billions in financing. Given current conditions, African sovereign loans often price at spreads of 500–800 bps over SOFR, providing healthy interest income for banks. Syndicated sovereign loans to Africa could average $5–10 billion per year, generating $120–220 million in fees and interest spread revenue annually for banks.

- Structured derivatives and contingent deals: Beyond TRS, other structured derivative transactions are being employed to manage African financing needs. These customized deals involve currency swaps, forward contracts or other bespoke arrangements offering higher margins than traditional bond underwriting. Although volumes are relatively limited, structured and synthetic financings are likely to remain a niche but growing supplement to Africa’s funding mix, potentially translating to a revenue pool of $50–100 million annually for banks.

Africa’s global markets financing is on the cusp of a significant growth trajectory, with the fee and interest revenue pool projected to reach $1.4 billion by the end of 2025, growing at a CAGR of 9%. This presents a substantial opportunity for global and regional banks to capitalize on the continent’s vast potential by delivering innovative financial solutions.

The debt trap: Risks and considerations

The rise of unorthodox financing in Africa has significant implications for banks, offering opportunities for expansion while also posing risks to the continent’s economic stability. As African nations accumulate debt through alternative financing channels with higher interest rates and stricter terms, they may face challenges in meeting their debt service obligations, potentially triggering a vicious cycle of debt refinancing and further indebtedness. To address these risks, a balanced approach is required—one that combines innovation with prudent risk management and tailors financing solutions to the unique needs of African economies, thereby minimizing the risk of debt distress.

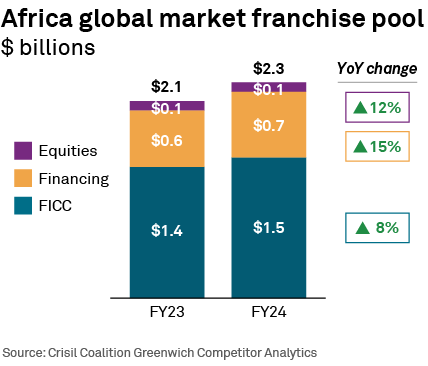

Africa global markets: 2024

The following chart shows the revenue pools of banks from global markets in Africa for FY24. Africa’s fixed-income capital markets delivered a strong revenue performance in FY24, with momentum largely driven by financing activity across North and Sub-Saharan Africa. The region’s growth was underpinned by macro shifts, FX-driven trading opportunities and increased institutional demand.

North Africa

Egypt stood out, following its March 2024 currency devaluation which created substantial trading opportunities for banks given the 50% market move. A healthy uptick in local rates and a surge in repo activity followed, as cross-currency transactions overall increased, driven by greater demand from institutional clients.

Sub-Saharan Africa

Nigeria remained the dominant market across Sub–Saharan Africa, with few global banks having onshore presence. This has further incentivized regional expansion plans for banks that currently have an offshore model, some of which already have representative offices. Robust vanilla trading was evident in the region, characterized by market swings analogous to Egypt’s FX devaluation scenario. Throughout 2024, Nigeria’s attractiveness as a carry trade opportunity grew, driven by incremental interest-rate hikes and persistent sticky inflation until mid-2025, when the central bank’s stance shifted toward a cutting cycle in the second half of the year.

Other markets that contributed to revenue growth include:

- Kenya and Zambia—showing strong potential in fixed-income activity

- Gabon and Senegal—niche, but profitable for select banks with local presence and financing arrangements

- South Africa—continued focus on swaps and bond market depth, with performance differentiated by client franchise and technology capabilities

- Ghana and Uganda—well-positioned for a pickup in 2025

Equities markets

- Trading volumes in both North and Sub-Saharan Africa spiked through 2024. Notably, Nigeria’s exchange recorded a nearly 40% year-over-year surge in both market capitalization and trading activity.

- OTC markets remain dominant in Africa’s derivatives landscape, boosted by geopolitical shifts and global volatility.

- Several exchanges are in the process of launching derivatives contracts, particularly index futures, which are expected to further boost derivatives trading.

- Equity financing remains an attractive space in the region.

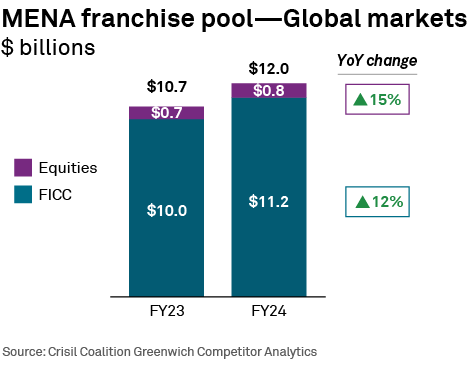

MENA global markets

The MENA region has witnessed a significant uptick in financial activity, driven by a surge in financing and a notable increase in the issuance of sukuk. The region’s debt capital markets have been particularly active, with Egypt and Saudi Arabia leading the charge. Africa’s share of the MENA region’s revenue pool is expected to increase over the next five years, driven by the continent’s rapid economic growth, rising demand for financial services, and increasing trade and investment flows.

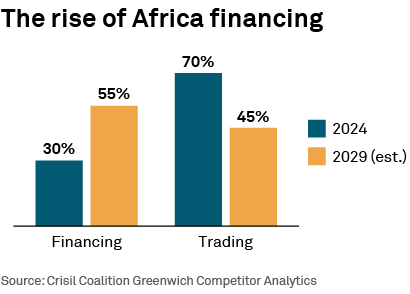

Countries such as Egypt, Nigeria and South Africa are expected to drive growth in the region. Furthermore, the region has seen a surge in financing and a notable increase in the issuance of sukuk. The share of financing in African secondary markets is poised to experience significant growth over the coming years, driven by rising demand for infrastructure development, expansion of bond markets and a growing focus on sustainable finance.

As the continent’s economies continue to grow and mature, the need for financing to support large-scale projects and initiatives will intensify, leading to a surge in bond issuances, loans and other forms of debt financing. By 2029, the proportion of financing in African secondary markets is expected to increase to 40–50%, up from approximately 20–30% in 2024, as governments, companies and investors tap into the continent’s vast growth potential and seek to address pressing development challenges. This growth will be fueled by innovative financing solutions, improved market infrastructure and a deepening of African capital markets.

Crisil Coalition Greenwich Competitor Analytics team members Bhavya Ahuja, Aamir Hazaria and Callum Minns are co-authors of this report.