Two decades ago, most corporate credit-investing strategies operated primarily by owning (or not) corporate bonds. Larger institutions utilized credit default swaps (CDS) to hedge default risk or gain synthetic exposure, but otherwise, bonds were it. Bonds were bought and sold via relationships and phone calls; systematic credit investing was rare, and systematic credit trading non-existent.

Fast forward 20 years: 44% of U.S. corporate bond volume trades electronically, up from nearly zero, with dealers executing nearly one-third of orders with no human intervention. Portfolio trades make up 10% or more of volume on any given day, credit ETF volume equates to 15–20% of the notional volume traded in the bond market, and systematic investing and trading is all the rage.

Despite this progress, a robust futures market—something taken for granted by interest-rate and equity traders—has, until recently, eluded the credit market. This is not for lack of trying. The first batch of new contracts launched in 2007 before the financial crisis hit its stride, with additional offerings coming after Dodd-Frank in 2012. Those contracts worked to mimic the CDS market, bringing CDS exposure into a futures framework under the assumption that new, more stringent oversight of the swaps market would drive traders elsewhere. That focus on converting swaps traders to futures and bringing futures traders into the credit market ultimately did not work.

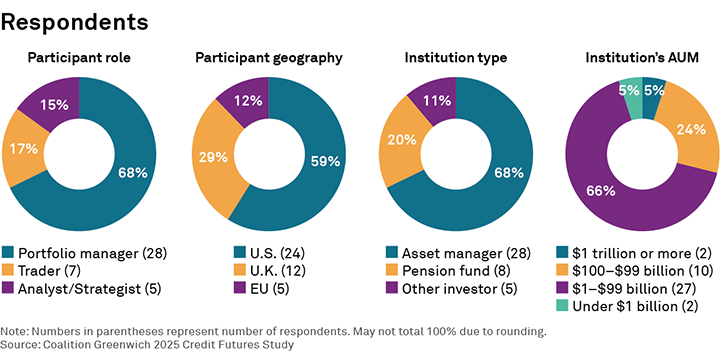

MethodologyCrisil Coalition Greenwich gathered 41 responses from credit investors in the U.S., U.K. and Europe in June 2025. Questions focused on the use of credit derivatives in the investing process, use of credit futures and future demand for credit-focused futures products.