Table of Contents

Yen fixed-income trading volume, excluding Bank of Japan bond buying volume, increased about 25% in the past year, more than offsetting the 15% decline two years ago. The aggregate market share of the five largest Japanese dealers now accounts for more than 56%, widening the gap between these dominant fixed-income dealers and both foreign and smaller domestic rivals. Meanwhile, foreign dealers continued their dominance in international (nonyen) fixed income amid a dip in trading volumes and a slowdown in activity among large investors.

Every year, Greenwich Associates asks institutions participating in its Japanese Fixed-Income Investors Study to name the dealers they use in specific fixed-income products, estimate the volume of business they allocate to each dealer and to rate these dealers in a series of product and service categories. In 2014, the Firm used input from nearly 450 Japanese investors to determine the Greenwich Share and Quality Leaders in Japanese Fixed Income. Greenwich Quality Leaders are dealers that receive client ratings topping those of competitors by a statistically significant margin.

Japanese Government Bonds

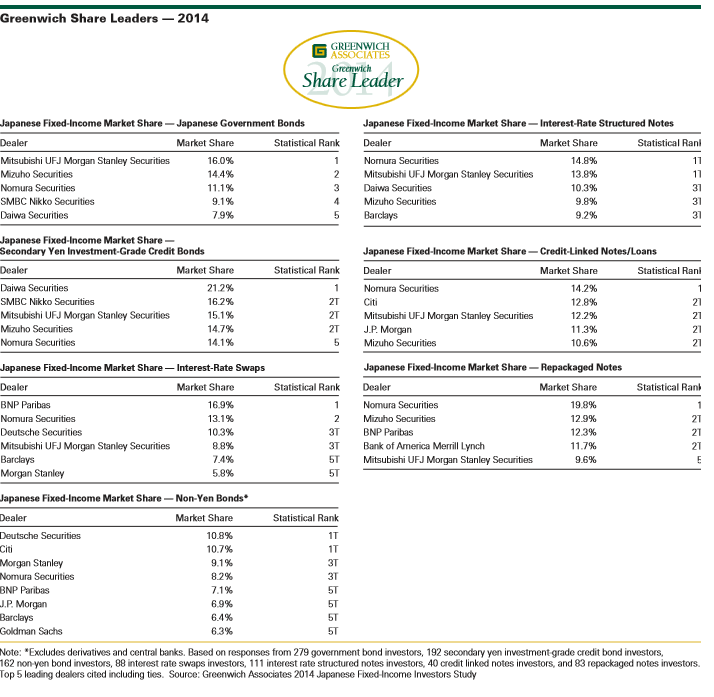

Mitsubishi UFJ Morgan Stanley Securities leads all competitors with a 16.0% market share in Japanese domestic government bond trading. Mizuho Securities ranks second with a market share of 14.4%, followed by Nomura Securities at 11.1%, SMBC Nikko Securities at 9.1%, and Daiwa Securities at 7.9%. These firms are the 2014 Greenwich Share Leaders in Japanese Government Bonds.

“The aggregate market share controlled by these five dealers increased last year, making this already concentrated market even more highly concentrated,” says Greenwich Associates consultant Tomio Sumiyoshi.

Behind the top rank of Japanese dealers is a group of no fewer than 11 foreign dealers led by BNP Paribas, which captured market share last year, and Goldman Sachs.

Yen Investment-Grade Bonds

The secondary trading market for yen investment-grade bonds is dominated by Japanese dealers to an even greater extent than that seen in Japanese government bonds. Due largely to their control of new investment-grade bond issues, the big Japanese dealers control up to 85% of secondary trading business. Daiwa Securities’ strategic commitment to credit products has helped the firm build a commanding position in this market with an impressive market share of 21.2%. Deadlocked behind Daiwa Securities are SMBC Nikko Securities, Mitsubishi UFJ Morgan Stanley Securities, Mizuho Securities, and Nomura Securities. These dealers are the 2014 Greenwich Share Leaders in Japanese Secondary Yen Investment-Grade Credit Bonds.

International (Non-Yen) Bonds

The competition for the international (non-yen) fixedincome trading volume of Japanese investors intensified last year as trading volumes dipped, some prominent dealers lost or ceded market share and other aggressive dealers gained ground. This decline in volume has been largely driven by a pullback in trading by a few large investors. On a matched sample basis, non-yen fixed-income trading volume declined by approximately 29% due to uncertainty about the direction of interest rates, which in the prior year most investors had expected to go higher.

At the top of the market this year are Deutsche Securities and Citi, which are tied with market shares of 10.7–10.8%. Next is Morgan Stanley, which made sizable gains in market share last year and is now tied for third place with Nomura Securities. Rounding out the top rank in this product is a group of four foreign dealers that are tied in market share, led by an up-and-coming BNP Paribas. These dealers are the 2014 Greenwich Share Leaders in Japanese Non-Yen Bonds.

Structured Notes, Repackaged Notes and Credit-Linked Notes/Loans

Japanese dealers and a handful of foreign dealers compete aggressively for trading business in several fixed-income products sold mainly to regional investors—often agricultural and Shinkin banks outside Tokyo. Trading business in structured notes, repackaged notes and credit-linked notes/ loans is considered attractive due to the relatively high margins it generates for dealers.

Nomura Securities and Mitsubishi UFJ Morgan Stanley Securities tie for the lead in structured notes with market shares of 13.8–14.8%, followed by Daiwa Securities, Mizuho Securities and the lone foreign competitor, Barclays, which are all tied at 9.2–10.3%. These firms are the 2014 Greenwich Share Leaders in Japanese Interest-Rate Structured Notes.

Among investors seeking yield enhancement, Nomura Securities is the clear leader in repackaged notes with a market share of 19.8%. Tied for the second spot are Mizuho Securities, BNP Paribas, and Bank of America Merrill Lynch. Mitsubishi UFJ Morgan Stanley Securities rounds out the 2014 Greenwich Share Leaders in Japanese Repackaged Notes.

Nomura Securities also leads in another yield-enhancement category, credit-linked notes/loans, with a 14.2% market share, followed by Citi, Mitsubishi UFJ Morgan Stanley Securities, J.P. Morgan, and Mizuho Securities. These firms are the 2014 Greenwich Share Leaders in Japanese Credit- Linked Notes/Loans.

Interest-Rate Swaps

In the interest-rate swaps space, volume is driven by a small number of large accounts. Here, global firms benefit as investors look to avoid credit risk. BNP Paribas secures the No. 1 spot with a 16.9% market share, while Nomura Securities earns second with 13.1%. Tied at third are Deutsche Securities and Mitsubishi UFJ Morgan Stanley Securities, followed by Barclays and Morgan Stanley in fifth place. These firms are the 2014 Greenwich Share Leaders in Japanese Interest-Rate Swaps.

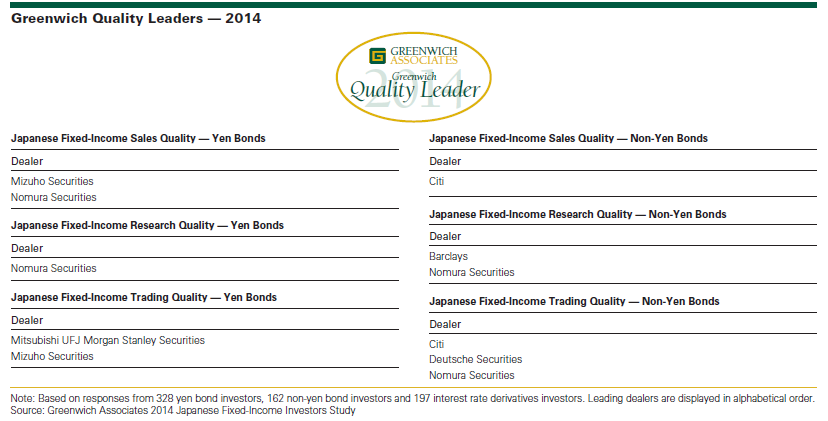

Greenwich Quality Leaders

In yen-denominated fixed income (including Japanese government bonds and investment-grade credit), Mizuho Securities and Nomura Securities are the 2014 Greenwich Quality Leaders in Japanese Fixed-Income Sales. In Japanese Fixed-Income Research, Nomura Securities is the 2014 Greenwich Quality Leader and in Japanese Fixed- Income Trading Quality, Mitsubishi UFJ Morgan Stanley Securities and Mizuho Securities are the 2014 Greenwich Quality Leaders.

In non-yen (international) fixed-income business with Japanese investors, Citi is the 2014 Greenwich Quality Leader in Sales, Barclays and Nomura Securities are the 2014 Greenwich Quality Leaders in Research, and Citi, Deutsche Securities and Nomura Securities are the 2014 Greenwich Quality Leaders in Trading.

Consultants Taeko Sumiyoshi, John Feng and Tomio Sumiyoshi advise on the institutional fixed-income market in Japan.

MethodologyBetween May and July 2014, Greenwich Associates conducted 328 interviews with senior investment professionals in Japan investing in domestic fixed income and 162 interviews with senior investment professionals in Japan investing in international fixed income. Interviews were conducted with banks, investment companies and insurance companies.

The findings reported in this document reflect solely the views reported to Greenwich Associates by the research participants. They do not represent opinions or endorsements by Greenwich Associates or its staff. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results.

© 2015 Greenwich Associates, LLC. All rights reserved. Javelin Strategy & Research is a subsidiary of Greenwich Associates. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.

The Greenwich Quality LeaderSM and Greenwich Share LeaderSM designations are determined entirely by the results of the interviews described above and do not represent opinions or endorsements by Greenwich Associates or its staff. Such designations are a product of numerical scores in Greenwich Associates’ proprietary studies that are generated from the study interviews and are based on a statistical significance confidence level of at least 80%. No advertising, promotional or other commercial use can be made of any name, mark or logo of Greenwich Associates without the express prior written consent of Greenwich Associates.