Table of Contents

In a turbulent year for financial markets, fund distributors in Europe are working to provide investors with some degree of certainty and diversification by bringing more asset managers with stable investment teams and top-notch risk management capabilities onto their platforms.

Every year, Crisil Coalition Greenwich interviews gatekeepers for private banks, retail banks, financial advisors (IFAs), and other fund distributors for our annual European Intermediary Distributors Study. In 2025, we asked 175 gatekeepers about the funds and managers on their platforms, the criteria they use in assembling platform offerings, and product demand and behaviors among their end investors.

Competition among asset managers on platforms is fierce. First, managers fight to get multiple funds included on the platform, but more importantly, managers battle for coveted spots on distributors’ recommended “buy lists,” which are often the key to unlocking meaningful asset flows from platform investors. As shown in the first graphic, the median 48 managers on a distribution platform are competing to get as many of their funds as possible included in the roughly 200 investment funds on the typical European distribution platform, and to be one of only about 65 funds included on buy lists.

While competition still rages on, this research revealed that fund distributors are increasing the number of managers on their platforms to meet expanding client needs. In 2024, European fund distributors included a median 30 asset managers on their platforms—the same number of managers featured in 2020. In 2025, that median number jumped to 48.

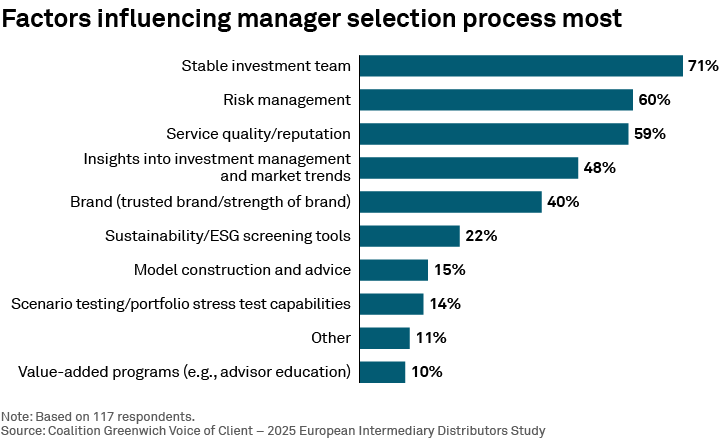

As distributors optimize the managers and products on their platform lineups, they are focusing on managers that demonstrate two qualities that seem to be of special importance in today’s marketplace. First, distributors are favoring asset managers with stable investment teams. Second, distributors are welcoming managers with demonstrated risk-management expertise. At a time of rising market volatility and increasing uncertainty related to hostilities in Ukraine and the Middle East, tariffs and trade wars, and other geopolitical risks, distributors seem to believe that investment teams with long, successful tenures and proven risk-management capabilities are best positioned to navigate the market cycle and provide a sense of confidence to end investors.

Where do fund gatekeepers find new managers and funds for their platforms? Although webinars and other online venues and content play a role, by far the biggest source of information about new managers are “in-real-life” gatherings, including third-party and in-house events in which asset managers present to distributors.

Fund distributors project sustained demand for European stocks

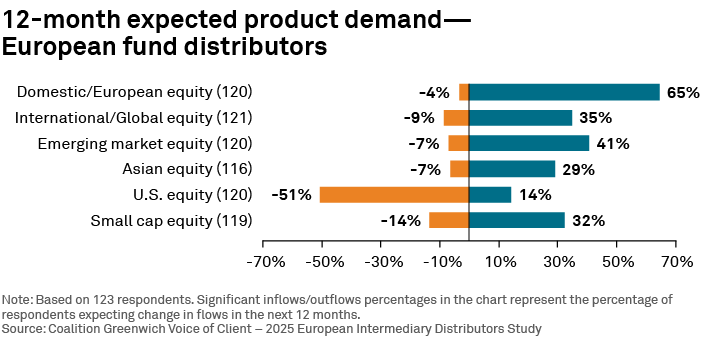

European fund distributors believe the strong performance of European equities in Q1 2025 had a big impression on the end investors on their platforms. European equities outperformed U.S. stocks in Q1 2025. Although that dynamic reversed in Q2 as the U.S. stock market recovered, European fund distributors think momentum created by the combination of relatively strong year-to-date performance and continued conditions like favorable monetary policy and plans to increase spending on defense and infrastructure will support sustained demand for European equities going forward.

The graphic above illustrates distributors’ expectations for sharply increased demand for domestic and European equities among investors on their platforms over the next three years and a corresponding loss of appetite for U.S. stocks.

As the chart shows, distributors expect demand to remain relatively robust across all equity categories outside of U.S. stocks. That positive vibe extends to most other asset classes as well, especially alternatives. Distributors believe investors on their platforms will continue substantially increasing their exposure to private equity and debt, infrastructure and commodities. Hedge funds are the one exception to that trend, in which distributors on net expect investors to trim allocations modestly.

![]()

Mixed signals on ESG

European IFAs are lowering ESG requirements for investment funds on their platforms. What does this trend mean for the future evolution of sustainable investing in Europe?

In 2024, two-thirds of European fund distributors said they required all funds on their platforms to have a clearly articulated approach to ESG. Although that share dipped to 57% in 2025, there is ample reason to believe the decline reflects the natural evolution of ESG into a standard part of the investment process in European asset management, rather than any loss of momentum for ESG. After all, if almost every fund has already integrated ESG into its investment parameters, there’s little need for this type of platform-wide requirement. The same thinking can explain why only a quarter of fund distributors expect to have an ESG requirement in place five years from now.

However, a closer look at the data raises some questions. Specifically, almost the entire drop in the use of platform-wide ESG requirements from 2024 to 2025 came from IFAs. In fact, the percentage of IFAs with ESG requirements has been falling for the past three years. In 2022, nearly two-thirds of IFAs had ESG requirements for funds on their platforms. That share dropped to 40% in 2023, to 33% in 2024 and finally to just 25% in 2025. Those results set IFAs apart from retail banks, private banks and funds of funds, for which use of ESG requirements still averages above two-thirds.

This dramatic pullback on the part of IFAs and the growing divergence in approach between IFAs and other distributors are trends worth watching. Given the increasing volatility of net asset flows into sustainable investment funds in Europe—and the strong pushback against ESG in the United States—we will be closely monitoring the decisions and behaviors of IFAs and other fund distributors in coming months for additional clues about the future direction of ESG in Europe’s retail investment market.

Global Co-Head of Investment Management Mark Buckley, Head of Investment Management—Europe Christopher Dunn and Alastair Brown advise investment management clients in Europe.

MethodologyBetween April and August 2025, Crisil Coalition Greenwich interviewed 175 regional and local gatekeepers at leading fund distributors in Europe. Respondents were asked to provide detailed information on their business priorities, quantitative and qualitative evaluations of their investment managers, and qualitative assessments of those managers soliciting their business. Interviews were conducted in Austria, Benelux, France, Germany, Greece, Iberia, Ireland, Italy, Monaco, Nordics, Switzerland, and the United Kingdom.