As we gear up for our annual round of research interviews with U.K. institutional investors and investment consultants, I always find it useful to take a step back and reflect. With the new year underway, I decided to dig into how the U.K. investment advisory landscape has evolved over the past decade—and what a transformation it has been.

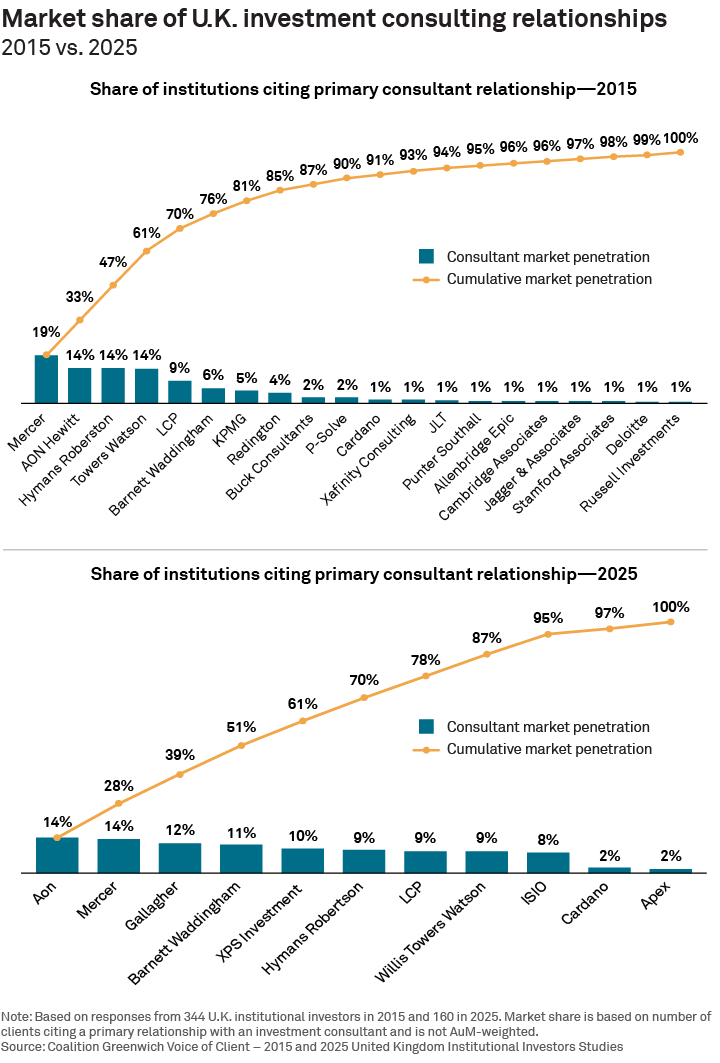

Each year, Crisil Coalition Greenwich conducts extensive interviews with hundreds of U.K. institutional investors, and, as part of that exercise, we ask them to identify the primary investment consultant with whom they work in an advisory, non-discretionary capacity. This approach enables us to extrapolate relative market share as a fraction of the raw number of primary relationships cited by institutions, which is visually represented in our charts—the blue bars indicate individual market share, while the gold line demonstrates the cumulative impact.

A comparison of the data from 2015 and 2025 reveals a marked reduction in the number of consultants cited. This contraction is primarily the result of a decade marked by mergers, acquisitions, rebrands, and strategic partnerships. Notable transactions—such as the merger of Willis Group and Towers Watson or, more recently, Gallagher’s acquisition of Redington—have fundamentally altered the competitive dynamics of the sector. Larger firms have absorbed many smaller participants, resulting in a more consolidated marketplace.

Despite these changes, however, no single consultant has run away with the lion’s share. In fact, the distribution of market share among the leading consultants has remained relatively stable. The major firms continue to dominate and crowd out all but the fiercest smaller competitors.

This trend raises important questions for the industry, and, as we look ahead to the next decade, it will be crucial to monitor how these shifts influence both the competitive landscape and the services provided to institutional clients.

Our upcoming research will continue to track these developments and provide insights into their implications for the U.K. investment consulting market. Please get in touch to learn more or to participate!

Christopher Dunn is the author of this publication.