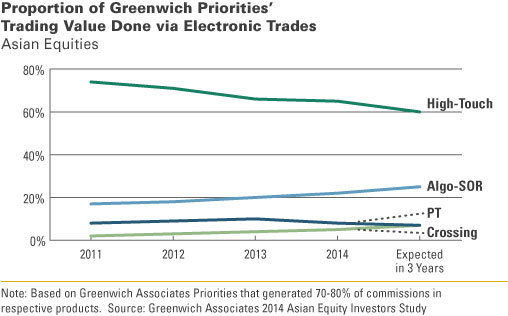

Institutions in Asia are executing a steadily increasing proportion of business on a low-touch basis (algorithms, DMA, crossing, portfolio trades) as opposed to traditional high-touch business executed through a broker sales trader.

These same institutions moved from roughly 75% of business executed via high touch in 2011 to 65% in 2014 with an expectation that high touch will decline further to 60% by 2017. By comparison, in the U.S., high-touch execution has dropped to 50% of order flow with an expectation of further declines to 45%.

The question is whether their expectation of further shifts will be realized?

Highlights

- The overall commission pool in Asia is little changed year- over- year with Greenwich Associates estimating a roughly $2.6 billion pool spread across 10 markets.

- Nearly two-thirds of commissions (according to traders) is allocated as compensation for research/advisory services. This business is more easily paid for via high-touch traders as the low commission rates pplied to low-touch trades tend to anchor “tack-ons” to pay for research at lower levels.

- Two-thirds of trading desks at larger Asian institutions request capital from their brokers for an average of 13% of their trading volume.

- Larger institutions report that roughly 25% of commissions are generated via trading in small/mid-cap shares.

Bottom Line

With low-touch rates typically half of high-touch bundled rates, institutions will certainly want to consider increased algorithmic trading an effective way to manage overall commission spend. However, factors such as liquidity, certainty of completion and market impact may ultimately trump rates in determining investors choice of high-touch versus low-touch avenues of execution.