Social media has become ubiquitous and in large part defines how we interact in a busy digital age. But not every platform is created equal, especially not for business and investing.

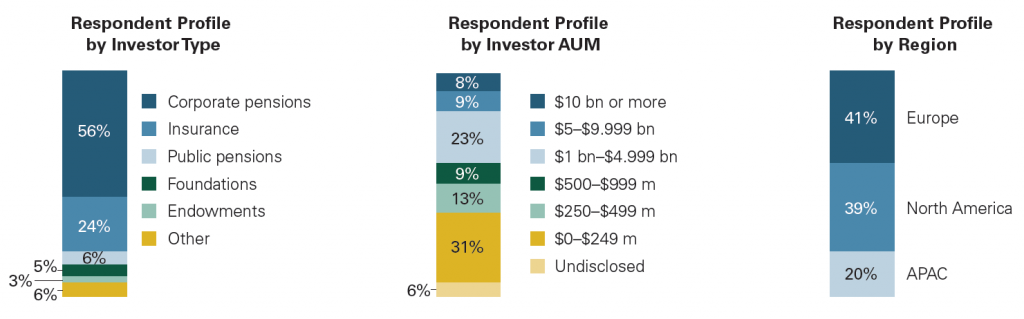

We recently interviewed 256 institutional investors—pensions, insurance, endowments, and foundations—to get a better understanding of if, and how, they use social media at work. The answer to the “if” question was a resounding “yes.” Seventy-seven percent of the respondents say they use social media in their profession role. And 52% cited LinkedIn as the most recently used social media resource for financial topics, compared with 43% for Facebook, 31% for YouTube, and 25% for Twitter.

The “how” question is where things get interesting.

LinkedIn is the top platform for business networking, having long served as a 21st century resume that is updated instantaneously and as an ever-expanding Rolodex holding past, current and potentially future colleagues—including those who never printed a resume or scribbled a contact’s name. While this is true for nearly everyone in the workforce today, its role for investors is unique as they turn to LinkedIn also as an investment research and education tool.

While Facebook and Twitter are also commonly used, LinkedIn is the tool of choice in a number of categories: researching specific industries, seeking opinions or commentary on markets/events; researching asset management firms, reading timely news or market/industry updates, seeking educational content to inform investing, and seeking recommendation of investment product/service.

Facebook is also popular for learning about investment products/services and group discussions. This could be driven in part by large asset management firms’ push into retail markets with mutual funds and retirement offerings marketed directly to individuals, rather than institutional investors.

Twitter shows up in our research as a platform useful for commentary on market events, but even in this category LinkedIn was still the leader. Institutional investors say that updates on LinkedIn are more targeted because they more accurately reflect their professional ties.

The numbers are interesting and show promise for social media’s growing use in financial services, but gauging how much influence these platforms have on actual investment decisions is a more revealing metric for future success.

Nearly 50% of respondents say the information they found on social media caused them to take action, most commonly following up with further research on a particular topic.

Nearly 50% of respondents say the information they found on social media caused them to take action, most commonly following up with further research on a particular topic.

About one-third of the participants confirm that the information found through social media has impacted their investment decision process. Some used the information to advance conversations with senior management and investment consultants, and others say the information did impact their investment decision and/or their selection of an asset manager.

Asset managers and other investment firms looking to attract investment dollars from pensions, endowments and insurance companies must evaluate the nature of their social media presence. It’s critical to maintain an updated company page and it can be beneficial to contribute regular content and insight, drawing potential customers back to their page again and again.

To request the full report, register here: Institutional Investing: How Social Media Informs and Shapes the Investing Process

And don’t forget to share the link, especially on your LinkedIn profile.