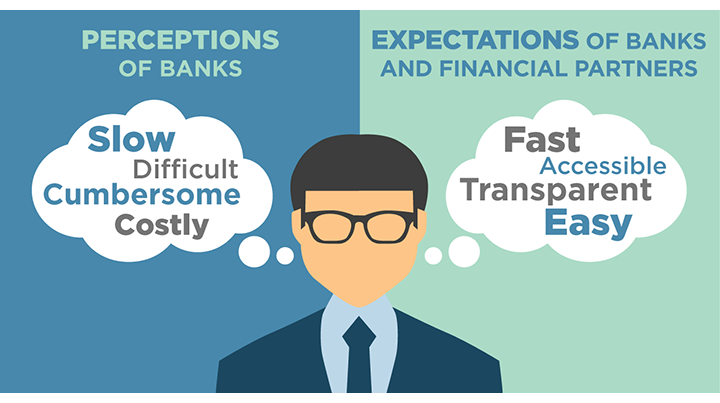

While bank customers are learning how fast, easy and transparent online service can be, banks are struggling simply to maintain the quality of service.

Non-banks and fintech providers, on the other hand, are leveraging cutting edge technology and are largely unregulated making it easier to deliver the type of service and experience customers have come to expect from the best Internet and mobile sites.

The industry will continue to experience this "digital divide" for the next five years as technology-fueled disrupters drive rapid and dramatic change in the financial landscape.

Bottom Line

- Fintech providers and other nonbanks are gaining more market share in lending, payments, merchant services, wealth management, and other areas.

- Clients will increasingly select separate “specialist best-of-breed” providers for these functions.

- Banks will continue to build out upgraded technology platforms and streamline processes to the degree legal and compliance teams allow.

- Advice is and will continue to be a key differentiator, with traditional in-person advice augmented or substituted by digital advice based on algorithms.

- Those lacking the technology and/or advisory talent are increasingly left behind.

Read the full report: The Future of Banking: 2025