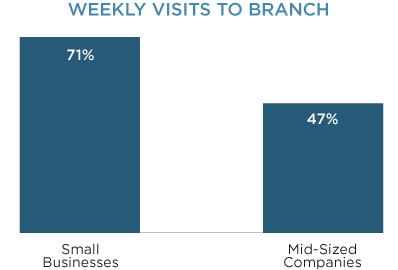

Reports of the death of the bank branch have been greatly exaggerated. In The Future of Banking: 2025 report, our research shows 71% of small businesses and 47% of mid-sized companies still visit the branch weekly for important banking services.

Bank branches are transforming with the times. Increasingly they will be equipped with video conferencing stations so customers can virtually meet with experts on any topic. It won't be long before leading banks’ branch systems are also equipped with artificial intelligence. This type of robo-advised human interaction can allow a much more solutions oriented interaction by certain branch professionals.

Branches are also specializing by location. For example, branches in affluent suburbs will be geared toward wealth management, while branches in busy business districts will focus on commercial banking.

Bottom Line

As more companies start relying on call centers and digital channels for banking functions, the decline in branch use seems inevitable. However, banks will use a blend of technology and customization to breathe new life into the branch, which continues to serve as an important source of sales and cross-sales.

The combination of the brick-and-mortar facilities with digital capabilities will enable banks to provide business customers with quick and easy access to product experts while minimizing costs. This process illustrates how traditional providers will fuse technology with expertise to create a new 21st-century banking model.

Find out what the most important services are for visiting a branch >>