If providing technology to enable electronic trading of corporate bonds was the first phase of the market’s evolution, then gathering, analyzing and putting data to work is phase two. The market will never be what it once was, with dealers willing to trade large block orders and hold them indefinitely to ensure their clients remained happy.

But as the market has sobered up and realized that the party is over, it is becoming increasingly apparent that tools now exist that can more than make up for the change in dealer behavior. Bond investors need only accept this medicine as the cure to what ails them, putting data to work to make better investments, better trades and ultimately to generate higher returns.

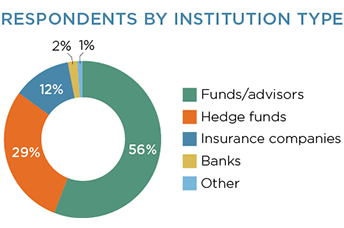

MethodologyIn the spring of 2017, Greenwich Associates interviewed 215 U.S.-based investors of investment-grade (IG) and high-yield(HY) credit. Study participants were asked about their total volume traded in these products over the past 12 months, the percentage of that volume executed electronically, how that volume was allocated across various trading venues, and other market-structure-related topics.