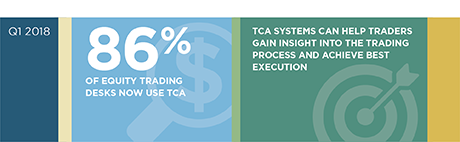

Transaction cost analysis (TCA) is now an essential tool on most equity desks, where traders leverage it to help them understand trading performance, optimize routing, and to see how they stack up against their peers. Regulatory initiatives such as MiFID II and the proposed SEC-enhanced order transparency rules will only increase the need for and usage of TCA across both buy-side and sell-side trading desks.

In this Greenwich Report, we delve into the details of how buy-side traders are using TCA, the platforms they use and the functionality they value most

MethodologyFrom June through August 2017, Greenwich Associates interviewed 102 buy-side equity traders globally to learn more about order-routing preferences, trading-desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and the impact of market structure changes on the sector.