The 2017 Greenwich Quality Leaders in Canadian Institutional Investment Management Services are Addenda Capital, Greystone Managed Investments Inc. and Phillips, Hager & North Investment Management. These firms have set themselves apart from competitors by providing exceptional service that often goes beyond the constraints of traditional investment mandates to help institutions achieve their primary organizational goals.

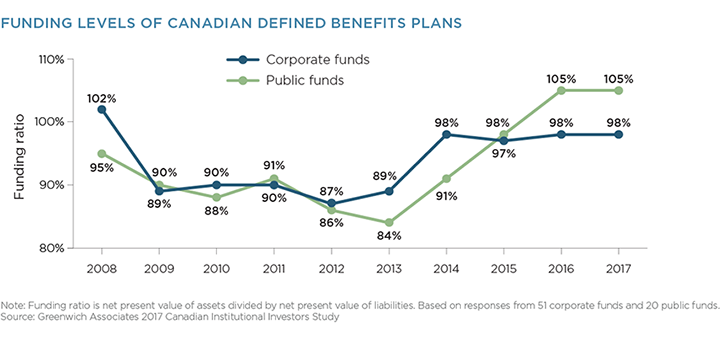

For Canada’s pension funds, the primary goal is clear: maintaining the strong funding levels they have worked so hard to achieve. Average funding levels for Canadian corporate pension funds were stable from 2016–2017 at 98%. For public pensions, funding levels held fast at 105% year-to-year.

Pension funds—along with other types of institutions—are increasingly relying on outside advisors like asset managers for advice and ideas about how to best navigate investment markets that are moving faster and becoming more complex. Leading asset management firms achieve this level of service by deploying senior professionals capable of having meaningful conversations about institutions’ holistic needs, and using their firms’ product sets and capabilities to deliver effective solutions.

“The Greenwich Quality Leaders understand that service cements relationships through good times and bad, and that over time, high-quality service will result in lower attrition rates during periods of underperformance and improved cross-sell win rates,” says Greenwich Associates Managing Director Davis Walmsley.

Consultants Christopher Dunn and Davis Walmsley advise our investment management clients in Canada.

MethodologyBetween July and October 2017, Greenwich Associates conducted 217 interviews with senior professionals at the largest tax-exempt funds in Canada, including corporate funds, Canadian subsidiaries of U.S. corporate funds, public sector and provincial funds, endowments, and foundations.

Study participants were asked to provide quantitative and qualitative evaluations of their asset managers, including qualitative assessments of those firms soliciting their business and detailed information on important market trends.