An array of factors, including an information explosion, new regulations, new technologies, and evolving commercial models, are coalescing to bring about significant change in the investment research landscape. In this study, commissioned by Thomson Reuters, Greenwich Associates interviewed 30 CIOs, portfolio managers and investment analysts to explore how the investment research market will change over the next decade.

The investment research market has not changed much over the last 40 years. Brokerage analysts collect and analyze financial company information and industry data, listen to and question corporate management, and build a variety of valuation models. They synthesize this information into investment research, which is pushed out to investors and money managers. These brokerage firms are then compensated through commissions on orders executed by the trading desk. While some of the technologies and techniques used may have evolved, the core investment research process has not changed significantly.

There is a notable shift underway, however. MiFID II regulations in Europe are mandating an unbundling of research from trading, increasing transparency on the investment research process and meaning that these services will be budgeted, evaluated and consumed separately from other services offered by investment banks. In addition, a number of other factors, including an information explosion, new technologies and evolving commercial models, will be reshaping the investment research landscape over the next five to 10 years.

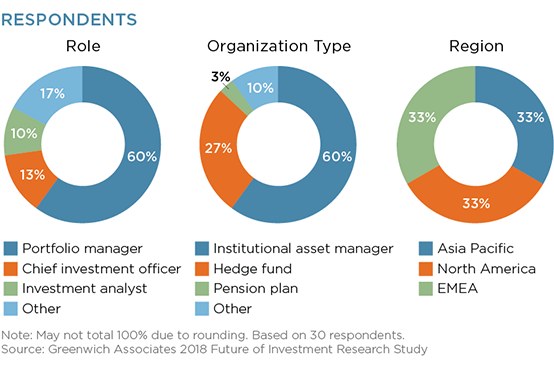

MethodologyBetween March and May 2018, Greenwich Associates interviewed 30 CIOs, portfolio managers, and investment analysts across North America, Europe and Asia. Respondents, representing asset managers, hedge funds and pension plans, were asked a number of quantitative and qualitative questions about how they think investment research will evolve over the next five to 10 years. Study methodology developed by Greenwich Associates and commissioned by Thomson Reuters.