The largest U.S. companies are allocating incremental business to banks with investments in digital platforms that streamline processes and make it easier for their clients to do business.

Press Releases

Electronic Trading Hits Critical Mass Across Asian Bond Markets

January 20, 2022

Data compiled by Coalition Greenwich has shown that in the past four years, there has been a notable increase in e-trading across corporate credit, not just in G10 investment-grade and hard-currency credit but also, in particular, in local currency bonds.

The influx of retail traders into options markets is making life harder for institutional trading desk

Institutions Assert Increased Influence Over Digital Assets

January 7, 2022

Digital asset market structure, which was built primarily to meet the needs of retail and high-net-worth investors, is coming under the increased influence of institutional investors.

Coalition Greenwich Names Top Market Structure Trends for 2022

January 4, 2022

Coalition Greenwich identifies the top trends in market structure and technology that will reshape the industry in 2022.

New Coalition Greenwich Report Identifies Innovative Technologies Helping Firms Shore Up Surveillance

December 14, 2021

Financial service firms are spending more than ever on surveillance technology, but the explosion of new communications channels like Zoom and Microsoft Teams could be creating dangerous gaps in the compliance infrastructure.

The convergence of algorithmic trading and transaction-cost analysis (TCA) is transforming foreign exchange trading by making it possible for market participants to more accurately measure trade execution quality which, in turn, ensures improved executions going forward.

With logistics bottlenecks disrupting the performance of companies around the world, institutional investors are seeking new sources of alternative data on supply chains to help inform future investment decisions.

For Corporate Banks, the Clock is Ticking on Sustainability and ESG

November 16, 2021

Banks that move slowly on sustainability are at risk of falling behind more proactive rivals and may lose business with important corporate clients.

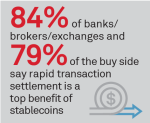

Stablecoin Issuers Look to Build Stable Foundation for Growth by Enhancing Transparency and Reserve Quality

November 9, 2021

The stablecoin industry is racing to attract institutional backing and achieve greater regulatory clarity by improving disclosure policies and adopting high-quality reserves.

Pages

Media Contact

Media Inquiry

Awards

- 2026 Coalition Greenwich Awards: U.K. Commercial Banking

- 2026 Coalition Greenwich Awards: U.S. Corporate Banking, Cash Management and FX

- 2026 Coalition Greenwich Awards: Europe Corporate Banking, Cash Management and FX

- 2026 Coalition Greenwich Awards: Asia Corporate Banking, Cash Management and FX

- 2026 Coalition Greenwich Awards: Global Corporate Banking, Cash Management and FX