Corporate banks should seize the opportunity to take on a more aggressive leadership role in pushing for a unified and simpler framework for environmental, social and governance (ESG) reporting. That’s the message we’re hearing in conversations with bankers at some of the world’s biggest corporate banks—and from executives at the companies those banks serve.

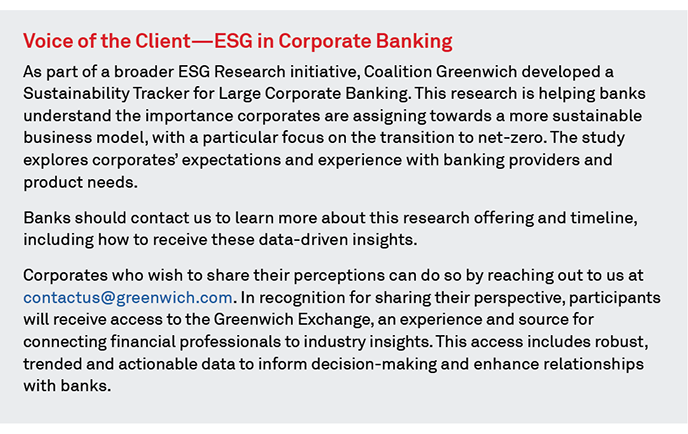

The vast majority of large companies around the world have adopted ESG in at least some capacity. In Europe, 9 out of 10 large corporates have established ESG goals and targets, as have 80% of large companies in the United States and about 70% in Asia.

But in all those regions, companies’ efforts to integrate ESG standards into their businesses are being hampered by a lack of any universal, or even consistent, framework for measuring and reporting ESG. Companies face a confusing morass of regulations, reporting standards, data sources, and methodologies put forth by governments, non-governmental organizations, ratings agencies, data providers, industry consortiums, and other players.

Although the European Union is trying to establish common ESG standards with initiatives like SFDR (Sustainable Finance Disclosure Regulation), the EU Taxonomy, and the CSDR (Corporate Sustainability Reporting Directive), at the moment, multinational companies have no way to determine which specific ESG standards, data and methodologies will win out, and which will fall by the wayside. That makes it difficult for companies to make the kinds of investments and process alterations necessary to integrate ESG into their workflows and funding structures.

Headwinds and “Green-Hushing”

In fact, the ambiguity surrounding reporting methodologies may be leading certain companies, and even banks themselves, to deliberately delay their adoption of ESG practices. Choosing the wrong reporting regime can have consequences that go beyond money lost to investments in frameworks that fall out of favor. Corporates and financial institutions alike are concerned that their lack of understanding about the ins and outs of ESG reporting techniques could expose them to the risk of “greenwashing” accusations if the company experienced some crisis related to environmental, social or governance issues.

In the industry, this phenomenon has become known as “green-hushing,” or intentionally underreporting on ESG to avoid running afoul of ambiguous standards. Unfortunately, these behaviors are likely to persist, creating headwinds to progress on ESG issues until industry, government and other constituents establish more-reliable norms.

For that reason, bankers and corporate executives are urging one another to coalesce around a single initiative or organization that can speak with a unified voice to regulators in jurisdictions around the world to push for a simple and consistent framework for ESG measurement and reporting.

Banks Are Pushing ESG Ahead

Banks have already proven their effectiveness in helping advance ESG in specific areas of corporate finance. In fact, for most large companies, the adoption of sustainable finance products represents one of the primary ESG accomplishments to date. Around the world, nearly 45% of large corporates have issued green or sustainable bonds, and 35% are using green, sustainable or ESG-linked loans.

Today, banks are helping corporates in Europe, North America and Asia implement sustainable supply chain finance, which roughly 1 in 5 large corporates currently use. Going forward, banks are positioned to play a prominent role in working to build out ESG solutions in corporate finance, treasury, capital markets (including emissions trading and carbon credits), mergers and acquisitions, and other areas.

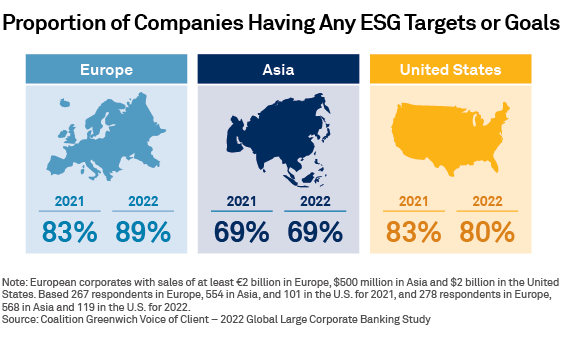

Companies are eager for their banks to assume that role. In the U.S., for example, 84% of large corporates say they want their banks to utilize their ESG experience and expertise to act as educators and advisors, and two-thirds of companies are looking to their banks for guidance on future regulatory changes. Around the world, about half of companies want their banks to go a step further and provide direct financial incentives for becoming more sustainable.

Meeting these requests from companies will give banks a series of concrete steps they can take in their daily work to make a positive impact on critical ESG issues—while also deepening their client relationships. However, due to their position at the nexus of corporate C-suites, financial markets and regulators, banks could have an even bigger impact by aggressively advocating for the creation of a simple, universal reporting framework that makes it easier and more economically attractive for companies to adopt and meet ESG goals.

Tobias Miarka, Melanie Casalis and Ana Voicila are the authors of this publication.