Rapid innovation in digital banking allows global and large regional banks as well as large fintechs to drive an accelerated wave of industry consolidation.

Historically, smaller banks in North America, Europe and Asia derived a competitive advantage from their long-standing relationships with local companies and expertise in their local markets. Regional and national banks in Europe and Asia and smaller regionals and community banks in the United States cemented their deep and long-standing ties with local clients with personalized service and reliable credit provision.

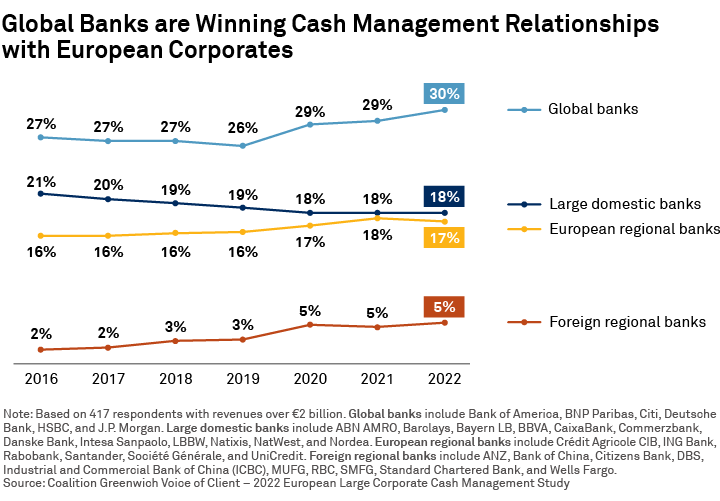

Those advantages are fading. In all these markets, the increasing importance of digital banking capabilities is helping global banks leverage their superior resources to win and deepen corporate banking relationships. Digital banking allows global and large regional banks as well as large fintechs to provide corporates with high-quality service without the need for extensive on-the-ground presence in local markets, keeping costs to service low.

As such, an increasing number of global and regional players which showcase digital innovative solutions and increased efficiency through digitalization managed to improve their position in the Greenwich Quality Index. This puts at risk the service advantage that has historically anchored the relationships between smaller regional banks and their corporate clients.

Balance Sheet Pressure

Digital banking is putting smaller banks under significant cost pressure. Some banks, especially local banks, historically relied entirely on their highly client-focused relationship managers and customer service teams, while their customers are demanding more efficiency, speed and accuracy, which is rapidly transforming the nature of corporate banking relationships. “Ease of doing business” ratings reached new lows over the past decade, as KYC and ALM regulations imposed heavy new documentation burdens on companies.

Until recently, these industry shortcomings actually worked to the advantage of smaller banks, whose personalized service models and more manageable client portfolios allowed them to deploy relationship managers and other professionals to help their clients work through these pain points, while clients of global banks struggled. But today, digital tools are helping banks streamline these processes and address at least some of the worst client headaches, while finding cost efficiencies. Meanwhile, the steady rollout of new digital features is allowing digital leaders to provide new levels of transparency, speed turnaround time and deliver increasingly error-free execution.

Smaller local as well as regional banks, like their global counterparts, are being forced to make sizable, ongoing investments in their digital platforms. That’s compressing margins in virtually all markets. If these trends continue—and we see no reason why they won’t—deteriorating balance sheets could force several smaller banks to reassess lending policies and potentially pull back on credit provision to some clients.

Competition for Talent

Over time, we believe global banks’ massive lead in digital banking will also translate into an advantage in the competition for talent. Young professionals are likely to see digitally innovative banks as more attractive career destinations. In addition, different talent is needed as banks increasingly realize data is the backbone of digitalization, triggering a desire to find talent that can collect, centralize, structure, and use data. That’s an important factor in a historically tight labor market, and at a time when banks are fighting with technology companies and other industries for the most promising employees.

Even more experienced bankers might come to see global banks as more appealing, as artificial intelligence and other digital solutions address historic service deficiencies and create new tools for bankers to employ in their daily work. That could lead to higher attrition rates for less technologically advanced banks, draining intellectual capital and institutional knowledge.

The United States

In the United States, these trends have already contributed to bank consolidation. Over the past 20 years, the number of U.S. commercial banks has been cut almost in half, from nearly 8,000 to just over 4,000. The collapse of Silicon Valley Bank, Signature Bank and First Republic Bank earlier this year revealed some troubling weaknesses in the balance sheets of regional banks that could point to additional risks ahead for smaller U.S. competitors. Given all these factors, we expect continued and even accelerating consolidation involving U.S. community banks, regional banks and universal banks. (See also, Reinforcing Resilience: Supporting Corporate Clients in the Adoption of Digital Solutions.)

Europe

In Europe, the growing presence of U.S. banks as corporate lenders is ratcheting up pressure on the regions’ banks and will almost certainly hasten additional industry consolidation. With large U.S. banks increasingly able to efficiently service local companies through digital offerings and more willing to leverage their lower funding costs and extend balance sheet, the moats that traditionally protected Europe’s national champions and other domestic providers are evaporating.

Across the region, we expect second- and third-tier providers will explore mergers and acquisitions as a means of gaining the scale needed to fund digital innovation and compete against increasingly aggressive global rivals.

Asia

The situation is more complex in the much more heterogeneous Asia region, where in general, global banks have been on a roll. For more than a decade, the biggest story in Asian banking was the rise of local providers, who rapidly built out capabilities and captured market share. Today, global banks are resurgent, winning new corporate banking and cash management relationships across the region.

There is no doubt that digital banking capabilities are playing a big role in that performance. But when it comes to technology, Asia’s regional and local banks have strengths of their own. Because many of these banks were not saddled with the legacy technology platforms that have slowed digital innovation among banks in other regions, smaller banks in Asia have proven themselves quite agile, impressing clients with the speed with which they are able to come to market with new features and functionality.

But even in Asia, large banks are gaining ground in some of the biggest markets. In India, for example, the share of large and middle market corporates working with one of the largest Indian private sector banks for overall corporate banking services increased to 38% from 33%. Over the same period, the share of corporates working with at least one large foreign bank climbed to 21% from 18%. The same trends, which are a result of a combination of regulations and market forces, were evident in cash management.

Despite the momentum of global banks and the region’s largest local providers across the region, we believe the consolidation wave that has already materialized in the U.S. and is closing in on the European marketplace will play out at a much slower rate in Asia.

Tobias Miarka and Ana Voicila are the authors of this publication.