We all know that the massive reduction in dealer inventories and the cost of capital has had a huge negative impact on liquidity in the corporate bond market. While the primary market has helped soften the blow, that crutch isn’t going to be here for long as rates start to rise over the next few months and years. Hence the renewed marketplace talk of corporate bond electronic trading.

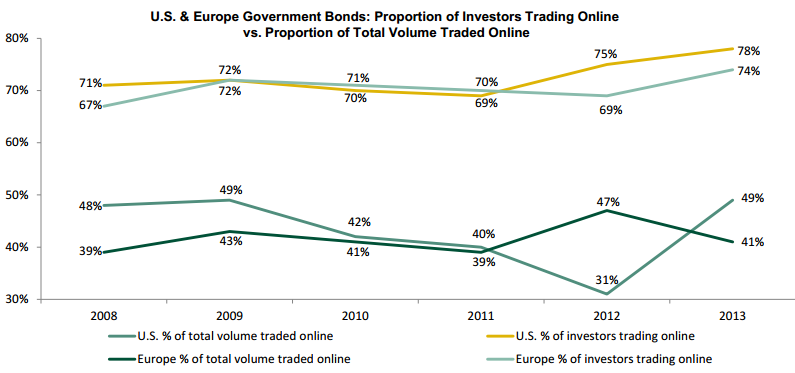

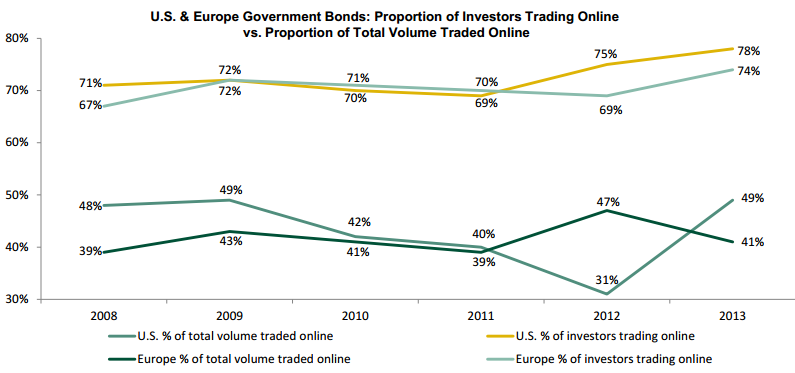

Our global fixed income study, based on 4000 interviews with global PMs and traders, did find that more market participants are trading fixed income products electronically, however the total volume put through those platforms has in fact declined. While that top line finding is interesting, its the product level details that tell the story in a more accurate way. Electronic trading in US Treasuries in on the rise amongst institutional investors for example. This makes sense from macro economic perspective, but also because on-the-run US Treasuries are standard and highly liquid.

The corporate bond story shows notably regional differences. While our research found that e-trading volume is down in the US, its up in Europe (you’ll have to read the report for our explanation as to why). While e-trading calculations using TRACE volumes (which includes smaller size trades not captured by our institutional interview base) show a slightly more rosy picture in the US (more on this in a later post), but they still show that while the market is in source of better corporate bond liquidity, the market structure has not changed in such a way that a burst of e-trading growth can be expected.

Bloomberg News did a great write-up on the research as well. The report is available for Greenwich Market Structure and Technology clients, but comments and thoughts are welcome from all.