Excel is the biggest killer app of all time. Yeah, web browsers are pretty useful and Instagram was sold for $1 billion, but when it comes to managing numbers nothing can touch Excel. This is why global financial markets continue to be run by Excel spreadsheets despite the torrent of advanced financial applications that have come into existence over the past 30 years. The folks at NPR's PlanetMoney actually did a great Podcast on this topic a few months back.

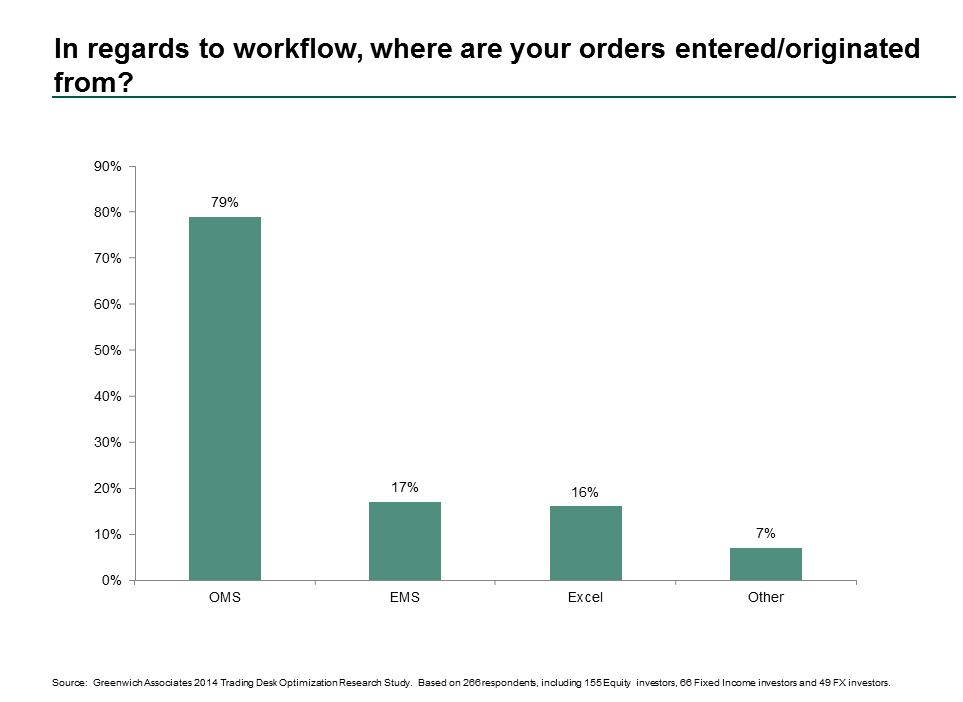

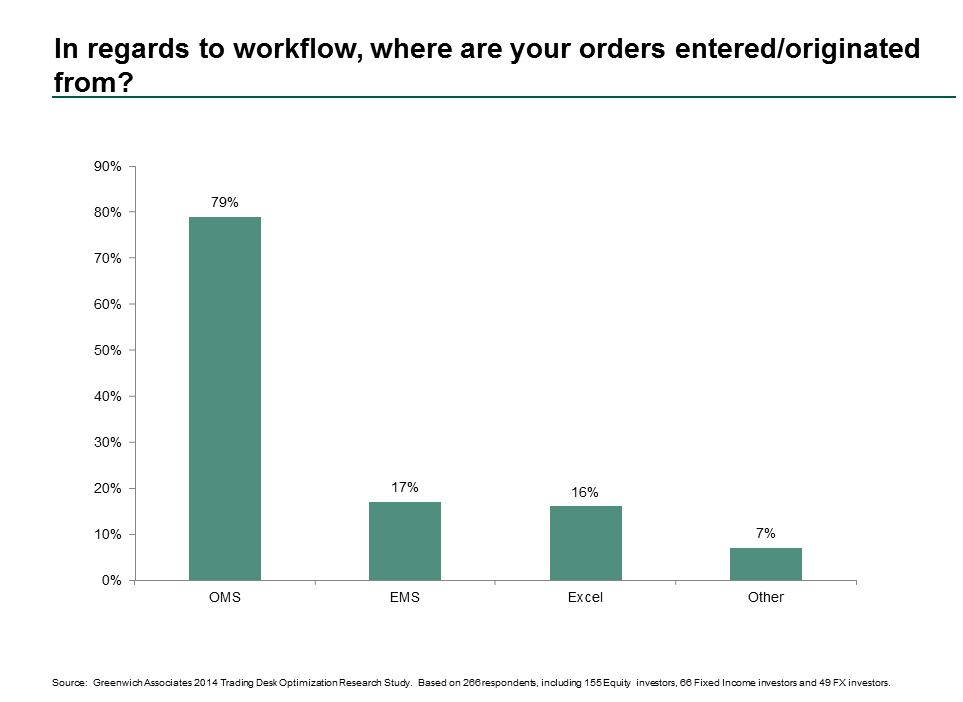

Bringing this post back to the world of market structure and technology, it turns out investors have finally realized there are places where nothing short of enterprise software will do. In fact it's somewhat crazy to think that money managers still exist that generate their orders from Excel. Of the 266 buy side traders we spoke with late last year, over 15% said their orders originate in Excel. Presumably these are the shops that use quantitative modeling to decide how and where to trade, and as such the Excel models used to make those decisions pushes orders into the EMS. Think of Excel as an automated portfolio manager.

But that's not the norm. Nearly 80% of buy side traders told us their orders come from their OMS, which is much more confidence inducing. Even if Excel is better at quantitative investing, OMSs are still famous (or maybe infamous) for ensuring the activity of the fund is in compliance with both internal and external policies. While this is good for ensuring nothing devious goes on, given that bad apples are thankfully few and far between, its more about catching inadvertent fat finger errors (regardless of whether the fat finger belongs to the trader or the algorithm).

I love excel (and PowerPoint for that matter). They basically take up 80% of my day. But when it comes to managing institutional trading, the OMS wins.