America’s smaller commercial banks are under increasing pressure. The collapse of Silicon Valley Bank and First Republic nearly caused a run on small and regional banks in the United States. Fast action by regulators to protect retail deposits and orchestrate an orderly takeover of First Republic helped staunch the flow of deposits from other banks that may have been perceived to be at risk.

However, the economic circumstances that contributed to these failures have not materially changed in the ensuing months. Smaller banks are facing competition so fierce that it might be causing some providers to take increasing levels of risk to sustain financial results. Leaders from responsible management teams are struggling to maintain profitability in the face of shrinking deposit bases, increasing funding costs, soaring compliance and technology expenditures, and a growing array of traditional bank and nonbank competitors.

Within the banking industry, the big three U.S. universal banks are capturing a growing share of commercial banking relationships. Bank of America, JPMorgan Chase and Wells Fargo currently hold lead bank relationships with 30% of small businesses and midsize companies, up from a low of 24% during the COVID-19 crisis. These banks are using their massive scale to roll out highly efficient and effective technology platforms that are now materially improving commercial relationships for both banks and clients. In addition, perceptions of “too-big-to-fail” status makes them attractive safe harbors for companies in today’s volatile markets.

Nonbank Competitors Pose a Threat

Banks also face competition from increasingly viable non-industry providers, including fintechs and nonbank/private equity lenders.

Large private equity firms and other nonbank lenders are expanding their presence in what has always been a core business for regional and smaller banks: commercial lending. Although regional banks still account for $4.5 trillion in loans or 40% of the U.S. total, nonbank lenders are expanding fast. That growth is actually accelerating in the current environment, in which a combination of dwindling deposits, tightening underwriting standards and increasing regulatory scrutiny are slowing bank lending.

Meanwhile, the persistent rise of fintechs poses a long-term threat to commercial bank revenue streams, deposits and customer relationships. Our data-driven insights show that $1.1 billion is at risk for small business banking and $2.2 billion for middle market banking in credit risk, given the shift from traditional bank providers to new entrants.

Those revenue losses could be just the tip of the iceberg. Companies that move payments and other treasury management functions to technology providers often shift their level of engagement as well. The migration of deposits to fintechs will obviously erode existing commercial banking relationships. The loss of deposits will also increase internal funding costs for commercial banks, making it even harder for smaller and regional banks to compete.

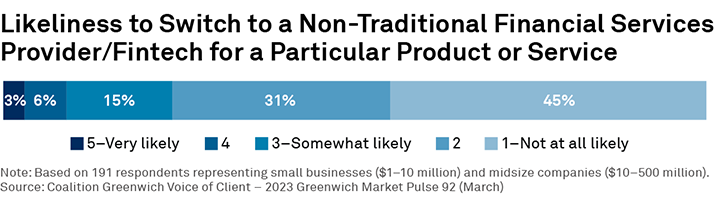

There is a silver lining for banks: For the moment at least, most small businesses and midsize companies remain hesitant about entrusting essential services to fintechs. More than three-quarters of commercial banking clients say they are unlikely to switch to fintechs for any product or service.

Although many companies remain reluctant to take the fintech plunge, fintechs are steadily growing their footprints in payments, cash management and other banking and treasury functions that, until recently, were the sole province of commercial banks. This success, combined with the advance of nonbank lenders, is slowly eating away at commercial bank revenues and profit margins.

A Wave of Consolidation Appears Inevitable

The impact of this competition is felt most keenly by regional and smaller banks. The big three universal banks have diverse franchises encompassing commercial banking, large corporate banking, investment banking, capital markets, cash/treasury management, and massive retail banking businesses. These banks can much more easily absorb any ebbs and flows in profitability from commercial banking or any other individual business. Their large and relatively stable deposit bases also make them less vulnerable to the increases in funding costs that are now contributing to the growing pressure on regional and smaller banks.

That pressure seems to be pushing the U.S. banking industry inexorably toward a future of consolidation in the ranks of our regional and small commercial banks.

This entry is Part Two in our analysis of the competitive dynamics of the U.S. commercial banking industry. In this series, we pay special attention to the increasing economic pressure on regional and small banks. We began this analysis in Part One with an examination of client trust levels in commercial banking. In this installment, we look at the new nonbank competitors that are moving aggressively to capture a share of the U.S. commercial banking market. Finally, in Part Three, we will explore what we expect to be one of the main the consequences of the pressure on smaller banks: industry consolidation.

The insights presented throughout this series come from the Greenwich Money in Motion platform. Money in Motion equips commercial bankers with unique, high-value client intelligence for the U.S. SME market derived from company-level data on approximately 1.3 million private companies, including wallet estimates, next-best product recommendations, attrition risk identification, wallet share analytics, and quality metrics for more effective prospecting, retention and pre-call planning.

Chris McDonnell, Cheri Derrick, and Kevin Seiler are the authors of this publication.