Table of Contents

The COVID-19 pandemic has forced the global economy into truly uncharted territory. Financial markets, being at the nexus of the economy, have been affected profoundly. Across Europe, all fixed-income market participants have had to rapidly adapt to this unique situation.

We gathered feedback from 94 buy-side fixed-income investors across Europe to learn more about the impact COVID-19 has had on their activity, how their dealers have responded, and what the future holds.

This post is part of the Navigating Turbulent Markets series. The first post, “Partnering with Clients in a Time of Market Turmoil,” covered the feedback from U.S. Investors.

With the initial, acute, stage of the crisis now behind us, investors face an uncertain landscape. How do they expect this to impact their trading behavior?

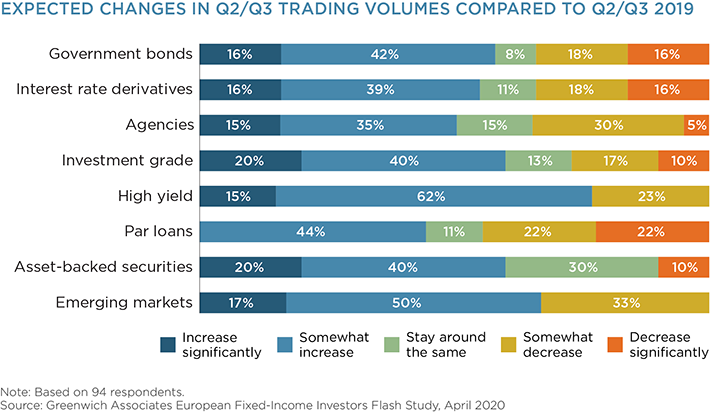

More investors in spread products (credit, ABS, and EM) expect their volumes in Q2 and Q3 to grow year-on-year. Rates investors also expect to execute greater volumes, but with less conviction than credit investors. Investors may be anticipating increased trading volumes due to the strength of the new issue pipeline as well as governments’ additional borrowing needs.

Compared to our 2019 European Fixed-Income Investors Study, where around half of investors we spoke with said they expected their volumes to stay the same, accounts have much stronger convictions about the direction of their trading volumes.

High-yield investors’ particularly strong expectations of increased volume indicate that they expect ongoing volatility in this market. There are many reasons for this: The pressure on the economy is going to push some companies into distress; fallen angels may change the composition of the HY market; or market dislocations might provide attractive relative-value opportunities.

Risky Business

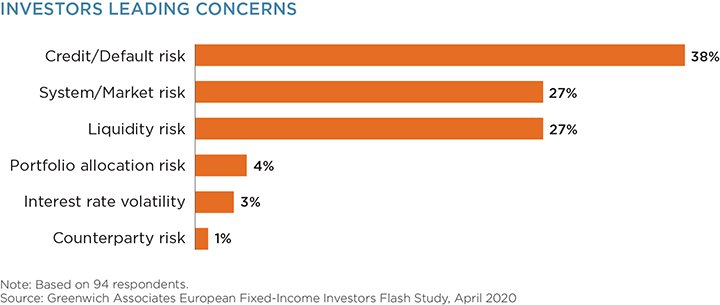

This aligns with the biggest concerns driving investors’ expected changes in volume. In response to a question about the most significant risk they faced, investors most frequently mentioned credit/default risk. This factor ranks as the No. 1 risk across all investor types, regions and almost every asset class.

Notably, credit/default risk ranked No. 1 with rates investors, implying that investors are anxious that this crisis risks morphing into another Eurozone crisis. Moreover, European investors more frequently mention systemic risk compared with their U.S. counterparts—potentially due to the greater complexity involved in managing the Eurozone.

In addition to credit risk, investors are concerned about systemic/market and liquidity risks. Few accounts mentioned other risks. Just one investor mentioned counterparty risk, indicating that the efforts to build resilience across financial institutions over the last decade have been largely effective.

Did Dealers Stand by Their Clients?

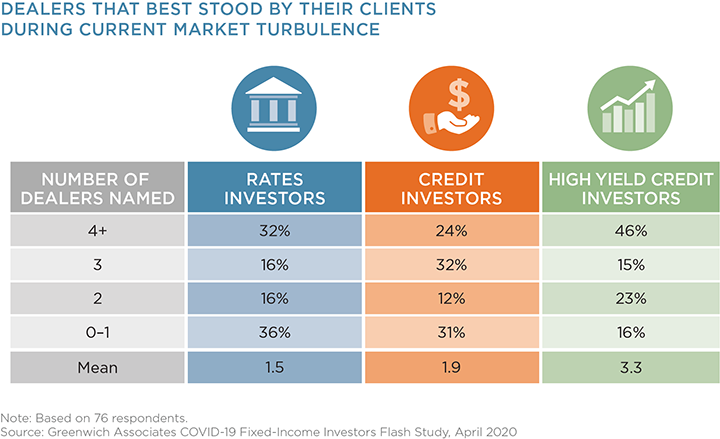

So which dealers are likely to benefit from this elevated activity? We asked accounts to list the dealers that stood by them. In a marked contrast to our U.S. results, where effectively all rates investors could name at least three counterparties that stood by them, in Europe nearly half of the clients named two or fewer dealers.

High-yield investors were most willing to praise their dealers—almost half could name four or more who stood by them and just one account didn’t name anyone. Given the volatility in this asset class, this is impressive.

While some U.S. bulge-bracket firms picked up the largest number of votes overall, some European dealers also resonated with their clients. This highlights the fact that relationships still matter, and detailed local knowledge provides a competitive advantage.

What Did Clients Value During the Crisis?

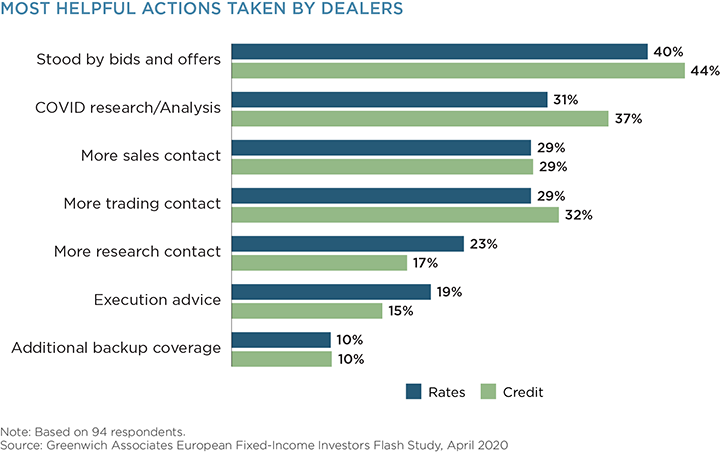

Rates and credit investors had similar priorities when they named the most helpful actions taken by their dealers. Unsurprisingly, execution appears to have been the clear priority, with over 40% of investors saying that standing by quotes was most important.

COVID-19 related research and advice was also important to both sets of investors (ranking second with credit investors and joint second with rates investors). Nearly all of these investors will have to pay for research under MiFID II, and may emerge with a renewed appreciation of the value of dealer-provided research.

At the same time, rates and credit investors valued additional contact with their dealers’ sales and trading teams. These factors ranked joint second with rates investors, and third with credit investors. Rates investors in particular also valued additional contact with analysts, reflecting the importance that they placed on advice.

These statistics underline the importance of relationships in what has been becoming an increasingly electronic market. With employees across both the buy and sell side working from home, personal contact has become an even more vital link to pick up market sentiment and color.

Did E-Trading Help or Harm Liquidity?

We estimate that electronic trading had reached 45% of European fixed-income volume. Greenwich MarketView’s U.S. data shows that electronic fixed-income volumes increased materially but slipped on a proportional basis, as market participants reverted to the phone. Anecdotally, we have heard that European fixed-income volumes followed a similar pattern, with higher electronic volumes, but a proportionally greater increase in voice volumes.

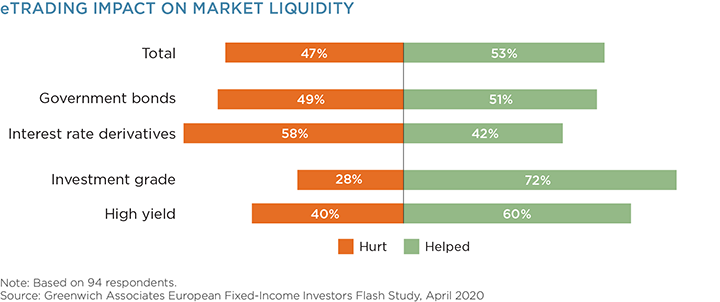

Investors’ views on whether e-trading helped or harmed liquidity are pretty balanced overall. However, digging into the numbers, we can see that investment-grade credit investors by a margin of 3:1, and to some extent high-yield investors, felt that e-trading helped rather than hindered liquidity.

In rates markets, government bond investors were evenly balanced between those who thought e-trading helped liquidity, and those that thought it hurt. In IRD, however, investors felt that e-trading hurt liquidity over the course of the crisis.

In contrast, U.S. investors overall believed e-trading helped rather than hurt liquidity by a factor of almost 2:1.

What Next?

Hopefully, Europe is passing the peak of this virus. Governments across the Continent are cautiously considering loosening the lock-downs imposed to blunt the transmission of the disease.

The most acute impact of the crisis on financial markets is almost certainly behind us. As the impact of the crisis on the real economy becomes clearer, investors will continue to adjust their portfolios, leading to greater trading volumes over the next few months.

This crisis has led to a renewed appreciation of bilateral human relationships and the value of advisory services, while e-trading has proved its resilience as an execution channel in times of market stress.

Regulations enacted since the 2008 financial crisis have made it more expensive for banks to make markets and hold inventory on their balance sheets. These regulations potentially accentuated the initial market volatility, but unlike 2008, they are not sitting on large trading losses. Hopefully, this means that dealers, unencumbered by souring trading books, will continue to be able to supply the market with the liquidity it needs.