When most people think of cryptocurrencies, they probably think of bitcoin. And a few might also think of Ether, the cryptocurrency that powers the Ethereum blockchain. Their next thought though, might be about one of the many scandals that have plagued cryptocurrencies since their inception: from Silk Road, to ransomware, or to the recent hacks of the Bitfinex crypto-exchange and the DAO project. Clearly cryptocurrencies have an image problem.

Although the financial services sector has embraced the underlying technology, blockchain (we estimate that the industry will spend $1bn on blockchain tech in 2016), financial companies have significant concerns about cryptocurrencies themselves. The publicly distributed nature of some of these blockchains and their perceived anonymityi does not align with traditional financial services where ‘knowing your customer’ and verifying sources of funds are vital regulatory requirements that help prevent money laundering and other financial crimes. With very few exceptions, most banks have stayed well clear of cryptocurrencies and from the startups building solutions around them.

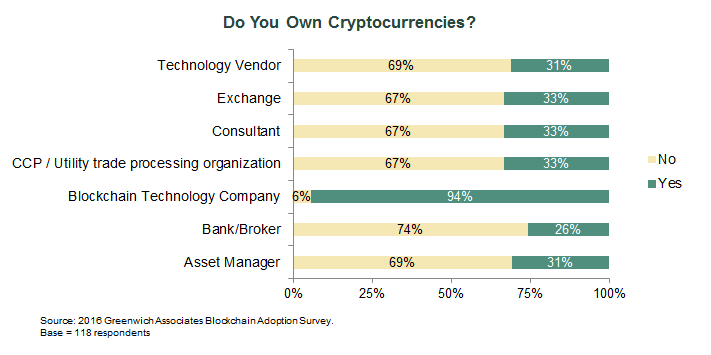

In our recent blockchain adoption study we wanted to test how deep the distrust of cryptocurrencies ran. The answer is not as deep as you might think… We asked respondents whether they owned any cryptocurrencies and the results are shown below:

In general within these financial institutions, about a third of the employees working on blockchain solutions also owned cryptocurrencies. Within blockchain technology companies this rose to 94%. So while most financial services companies do not want to be associated with crypto, many of their employees have no such compunction.

So what would it take for banks to get on board with owning and trading cryptocurrencies? Well in fact, this has already happened. Last week, Ripple announced that R3 CEV in conjunction with 12 of their member banks had used the digital currency XRP in a trial of inter-bank cross-border payments.

XRP is the digital currency created by Ripple. Although anyone can buy or own XRP, the underlying technology and consensus algorithm is owned and maintained by Ripple. This means that, unlike other cryptocurrencies, there are no unknown ‘miners’ verifying transactions on the network and generating new currency tokens. This eliminates many of the concerns banks may have about using the cryptocurrency.

In cross border payments today, a correspondent bank has a network of global banking relationships and accounts that it uses when it needs to effect a cross border payment. This can be expensive and slow, especially if the payment needs to go outside the standard corridors. Ripple sees XRP as a bridge currency that can eliminate the need for banks to have numerous global ‘nostro’ accounts, and by leveraging distributed ledger technology, it can significantly reduce settlement times. For this to work, there needs to be liquid markets in multiple XRP currency pairs, and there are already a number of market makers providing two sided liquidity in this market.

Whether XRP takes off as a bridge currency and whether this leads to a broader acceptance of cryptocurrencies, remains to be seen. What this does tell us however, is that banks aren’t completely against cryptocurrencies – if compliance concerns can be satisfied, then they are open to exploring any new technology that can reduce costs and improve workflow.

i. Technically owners of cryptocurrencies are not anonymous, but pseudo-anonymous, meaning that transactions can be tracked by referencing the public address of the user.