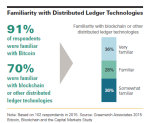

The potential applications of blockchain-style distributed ledgers in the institutional capital markets are many and recent research by Greenwich Associates finds that risk reduction tops the list of...

Corporate bond investors receive an outsized portion of liquidity from the sell side and will continue to do so going forward.

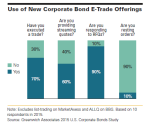

Electronic trading has created pathways to new sources of...

By requiring investors to set research budgets based on specific monetary values for the sell-side products and services they consume, the new rules could prompt asset managers to cut back on the...

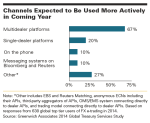

Institutional investors now execute half their FX notional volume via multidealer trading platforms, up from 38% in 2008. Greenwich Associates expects that number to rise, as 67% of the global top-...

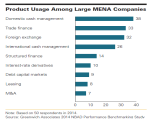

Local banks in the MENA region are expanding and upgrading their products and services.

Companies in the region should be reaching out to these local providers as a source of “high-touch” coverage...

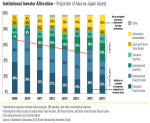

In 2015, Asian institutions hold an estimated $12 trillion in investment assets—up from just $7 trillion in 2011. Amid this remarkable growth in portfolio assets, allocations to domestic...

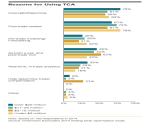

According to the results of a recent study by Greenwich Associates, the majority of equity investors utilize transaction cost analysis (TCA), with high-volume equity trading desks being the biggest...

Companies today are increasingly upbeat about the economy and finally able to focus on growing revenues, as opposed to cutting costs—the dominant strategy in 2009–2010.

These newly...

The widespread reliance on Microsoft in finance has allowed some firms to overlook potential developments in other operating systems.

Going forward, developing software for internal or client use...

While the majority of cash equity commissions are currently allocated to brokers as compensation for research services, European regulators contend that while investment managers are more rigorous...