The fixed-income market has proven challenging since the financial crisis.

The market rarely does what investors expect, and dealers have seen their profits cut by new regulations, low...

With much of the SEF mandate shock behind us and true execution data more readily available than ever before, examining the order book’s potential beyond its current usage is prudent. For...

A formal review meeting with an investment consultant can be a make-or-break moment for an asset manager. A chance to meet a consultant face-to-face for a formal meeting represents the culmination of...

As the complexity of U.S. equity trading continues to escalate, institutional investors leveraging transaction cost analysis (TCA) for post-trade analysis and compliance reporting are now looking at...

The institutional financial markets are undergoing continual change as new regulatory requirements and technological advances make change inevitable.

This report estimates that buy-side...

New

Nearly every major market has seen electronic trading grow over the past decade. Some have seen an organic transformation, while others have had their hand forced by new regulations.

Regardless,...

New

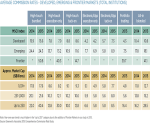

Despite regulatory reforms, volatile markets and debate about potentially radical changes to market structure, “headline” commission rates paid by institutional investors on global equity trades held...

New

The results of the 2015 Greenwich Associates Exchange-Traded Funds Study show that results of Greenwich Associates debut Asian Exchange-Traded Funds Study show the potential for further growth....

2015 brought with it another wave of negative press about dark pools with revelations of impropriety and fines from regulators. Although the volume executed through dark pools has not changed...

ETFs are becoming a staple of European institutional equity portfolios. The results of the Greenwich Associates 2015 European Exchange-Traded Funds Study show that equity and fixed-income ETFs are on...