With technology innovation and regulatory complexity accelerating the pace of change, the level of competition among order and execution management system (OMS and EMS) providers remains consistently intense.

Regardless of whether traders seek a highly specialized or more comprehensive system, deciding which option to choose and how to best support the development and hosting of these platforms remains a major challenge. This is driving many participants to onboard multiple platforms in their ongoing effort to satisfy different business needs.

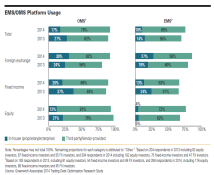

MethodologyBetween August and September 2014, Greenwich Associates interviewed 358 buy-side traders across the globe working on equity, fixed-income or foreign-exchange trading desks to learn about trading desk budget allocations, trader staffing levels, OMS/EMS/TCA platform usage, and ATS satisfaction levels.

The data reported in this document reflect solely the views reported to Greenwich Associates by the research participants. Interviewees may be asked about their use of and demand for financial products and services and about investment practices in relevant financial markets. Greenwich Associates compiles the data received, conducts statistical analysis and reviews for presentation purposes in order to produce the final results. Unless otherwise indicated, any opinions or market observations made are strictly our own.

© 2015 Greenwich Associates, LLC. Javelin Strategy & Research is a division of Greenwich Associates. All rights reserved. No portion of these materials may be copied, reproduced, distributed or transmitted, electronically or otherwise, to external parties or publicly without the permission of Greenwich Associates, LLC. Greenwich Associates®, Competitive Challenges®, Greenwich Quality Index®, Greenwich ACCESS™, Greenwich AIM™ and Greenwich Reports® are registered marks of Greenwich Associates, LLC. Greenwich Associates may also have rights in certain other marks used in these materials.