Recent research by Greenwich Associates reveals that investors will increasingly look to futures as the most cost-efficient method of expressing their views on interest rates.

Regulatory impacts, including higher margin requirements for swaps, will have a greater impact on the total cost of the trade in the coming years, as clients have less eligible collateral on hand. Furthermore, the liquidity cost gap between swaps and futures will likely widen as banks find it more difficult to make money trading cleared swaps.

The research also indicates that swaps, both cleared and bilateral, will continue to have their place, and those markets will continue to be robust, albeit on a smaller scale than before the crisis.

Many market participants are willing to pay up for customization that the swaps market allows, and the research shows that the cost differentials will still allow those in this camp to continue on as is.

MethodologyThe core of this study is based on a proprietary quantitative model designed to analyze the variation in costs associated with trading various interest-rate futures products as compared to comparable cleared swaps. The model calculates the cost of opening a position, maintaining that position and then closing out that position. The costs of each are encompassed in four cost buckets:

- Liquidity: Defined broadly as the bid-ask spread for the given instrument

- Initial Margin and Funding Costs: Includes the amount of initial margin that must be posted by product and the cost of funding that initial margin

- FCM Fees: Execution fees, clearing fees and capital usage fees charged by the futures commission merchant

- CCP Fees: Exchange, execution and clearing fees charged by the relevant clearinghouse

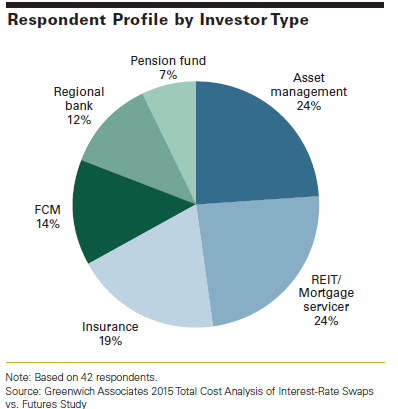

In an effort to validate the model, determine the correct inputs and define the most realistic scenarios, Greenwich Associates conducted a total of 42 telephone interviews between September and December 2014 with portfolio managers, traders, and other interestrate trading experts. With responses relatively consistent across the respondent base, we felt this sample size sufficiently reflected the market’s views. The interviews were conducted in two distinct phases, during which we validated both our assumptions and our methodology.

Study participants provided average bid-ask spreads for various cleared-swap trades, the frequency at which they execute futures at the mid-point, FCM clearing fees, the amount of initial margin they currently finance, and several other quantitative and qualitative data points. These results were used to create several scenarios aimed at identifying where futures provide a valid (and in some cases obvious) alternative to cleared swaps and where current trading habits are best left intact.