The winners of the 2019 Greenwich Excellence and Greenwich Best Brand Awards in U.S. Middle Market Banking all have one thing in common: they deliver traditional banker advisory values along with the...

Digital banking capabilities are now the most important driver of perceptions of ease of doing business and new data from Greenwich Associates shows that the “effectiveness of digital channels” now...

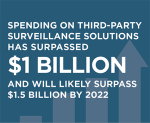

After several decades of relegation to the back office, 21st century compliance departments have emerged as front-and-center players in modern capital markets infrastructure.

Banks, asset...

The market should celebrate how much more efficient it has become in the past decade. Burdensome regulations, reduced profit margins and low-volume markets have been mitigated by new businesses...

The 2019 Greenwich Quality Leaders in U.S. Institutional Investment Management Service are AB, Baillie Gifford, NISA Investment Advisors, and PIMCO. These asset managers have distinguished...

The 2019 Greenwich Quality Leaders in Canadian Institutional Investment Management Service are Jarislowsky Fraser, Phillips, Hager & North Investment Management, and TD Greystone Asset...

This report provides detailed information from U.S. corporates on key findings and market trends in large corporate cash management.

This report provides detailed information from U.S. corporates on key findings and market trends in trade finance.

This report provides detailed information from U.S. corporates on key findings and market trends in corporate banking.

The growth of exchange-traded funds over the last 25 years has been one of the biggest secular trends in investing. Closely tied to the rise of passive investment management, ETFs allow investors...

Pages

Need to Contact Us ?

We are always here to help you

What We Offer

Our experts are happy to help you with your specific research needs. Schedule a consultation