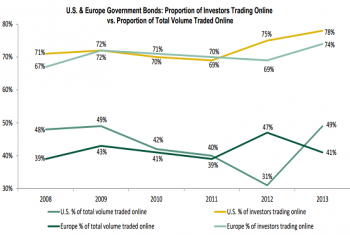

Electronic trading of bonds is growing – sort of…

We all know that the massive reduction in dealer inventories and the cost of capital has had a huge negative impact on liquidity in the corporate bond market. While the primary market has helped soften the blow, that crutch...