Canadian Institutions Use ETFs for Strategic and Tactical Applications

More institutions are looking at ETFs not just as tools for tactical portfolio adjustments, but as a means of efficiently implementing their broader investment strategies.

More institutions are looking at ETFs not just as tools for tactical portfolio adjustments, but as a means of efficiently implementing their broader investment strategies.

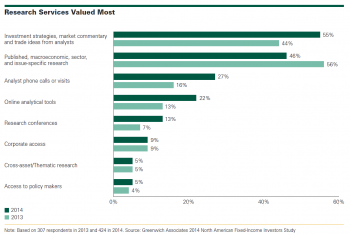

The percentage of clients rewarding dealers for fixed-income research doubled over the last two years and research in more illiquid products is even stronger.

German institutional investors are adjusting investment strategies and portfolio allocations in an attempt to generate yield amid low interest rates and declining return expectations. As they do so, they give top marks to Allianz Global Investors...

Compensation for retail structured products professionals remained flat.

Compensation for financial professionals trading Fixed Income products in Canada increased slightly in the past 12 months.

Compensation for financial professionals trading Latin American Fixed Income products increased slightly in the past 12 months.

It’s official: The Canadian Big Six are now the Big Seven. Desjardins Capital Markets has joined RBC Capital Markets, TD Securities, BMO Capital Markets, Scotiabank, CIBC, and National Bank Financial to gain entry into the country’s...

Compensation for financial professionals trading Fixed Income products in the U.S. increased slightly in the past 12 months.

Total compensation for Equity Derivatives traders increased last year.

Total compensation for Equity Derivatives traders increased last year.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder