Demand for domestic public bonds fell 4% from last year but demand for USD public bonds feel even more, at 7%.

Process Improvement of Working Capital Management remains the key reason for use of trade finance in Asia, as compared to Usage Requested by Counterparty, which is cited by European and U.S. companies as their primary driver.

With the exception of Natural Resources and Financials companies, most industries experienced a drop in the average number of investment banking relationships.

Willingness to provide credit and the overall strength of bank relationship were the primary factors in determining lead mandate for long-term bond offerings.

Total compensation for Convertibles traders increased last year.

The impact of Basel III on Trade Finance Pricing is beginning to stabilize, with more than a third responding that the impact will stay the same, and although 59% believe it will increase, this is a steep decline from 80% in 2012.

Non-bank financials allocated 44% of their credit related fees and interest to their primary bank as compared to the average allocation of 27%. Consumer, Services and Insurance companies allocated one third to their primary bank while...

Domestic cash managers captured almost 80% of fees paid as compared to those allocated to international cash management.

Total compensation increased across most industries when looking at year-on-year average salaries and bonuses. However, some industries fared better than others.

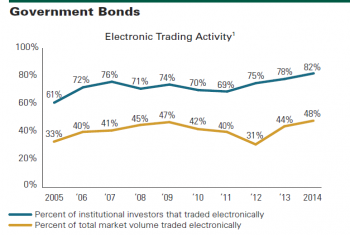

Platforms Battle for Share as eTrading Grows for Rates Products

After bottoming out at 31% in the midst of the global financial crisis, the share of overall U.S. Treasury trading volume executed electronically climbed to 48% in 2014.

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Financial News: Equity trading revenues have surged in the second quarter, driven by...April 30, 2025

-

SPGMI: Tariffs may reduce trade volumes, potentially impacting bank revenue, though they could also...April 28, 2025

-

SPGMI: Combined revenues of the world's 12 largest securities services banks increased by 5%...April 28, 2025