2014 U.K. Institutional Investors - Product Demand and Hiring - Data

Hedge fund use declines as investors switch to multi-asset allocations for their alternatives exposure.

Hedge fund use declines as investors switch to multi-asset allocations for their alternatives exposure.

Supported by rising bond yields, funding levels improve, but the gap between corporates and local authorities widens.

The largest seven consultants manage 76% of U.K. institutional investor relationships, down from 81% last year, as small and mid-size consultants grow in importance.

The secular decline in equity allocations has resumed to the benefit of fixed income and LDI.

Blended default funds continue to gain significant traction among DC schemes.

Hedge fund use declines as investors switch to multi-asset allocations for their alternatives exposure.

Supported by rising bond yields, funding levels improve, but the gap between corporates and local authorities widens.

The largest seven consultants manage 76% of U.K. institutional investor relationships, down from 81% last year, as small and mid-size consultants grow in importance.

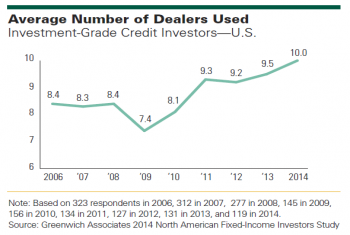

The evolution of the U.S. corporate bond market is underway, but the revolution is yet to come.

The secular decline in equity allocations has resumed to the benefit of fixed income and LDI.

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder