2016 Most Helpful Traders and Analysts - North American Fixed Income Investors - Municipal Bonds

This report provides detailed information from municipal bond investors in the U.S.

This report provides detailed information from municipal bond investors in the U.S.

Across the Continent, institutional investors are looking into new asset classes with higher expected returns to compensate for low returns in core fixed income and equity investments.

Greater flexibility and less onerous regulation allows corporate and public pensions to diversify their portfolios while banks, savings banks and insurance companies have not yet progressed.

The search for better returns drives more demand for real estate and global equities while usage of specialist fixed income strategies remains high.

Low interest rates push investors towards greater diversification in search of higher returns but risk management capabilities pose a challenge.

Low interest rates push investors towards greater diversification in search of higher returns but risk management capabilities pose a challenge.

This report provides detailed information from institutional investors in Germany, including helpful benchmark data such as manager fees paid.

Investors' lack of resource and expertise increases the importance of knowledge transfer and customization to needs as hiring criteria for external managers.

Demand for investment consultants remains low as German institutions turn more to asset managers in their increasing need for advice.

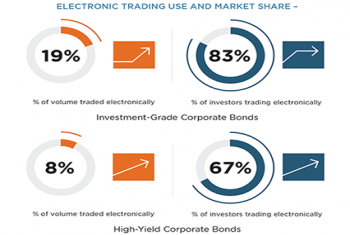

The story of electronic trading growth in the corporate bond market continues. Over 80% of U.S.-based credit investors now transact investment-grade corporate bond trades electronically...

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder