Compensation report covering salary and bonus data from equity traders and portfolio managers in the United States.

Compensation Report covering salary and bonus data from equity traders and portfolio managers in Canada.

Asian institutions are diversifying portfolios and seeking new sources of yield by shifting assets to more narrowly focused investment strategies.

Overall, average total compensation remained stagnant among German institutional investors.

Most job functions experienced an increase in total compensation.

Most institutions offer more than 15 sick days and allow their employees to rollover their vacation days.

Flat E-Trading Volumes in U.S. Equities Mask Increase Among Larger Accounts

Anyone operating in the U.S. equity market knows it is challenging times. The continued pressure on commissions remains the main story for the buy side, sell side and technology providers operating in the space.

Most job functions experienced an increase in total average compensation, mainly driven by increases in average bonus.

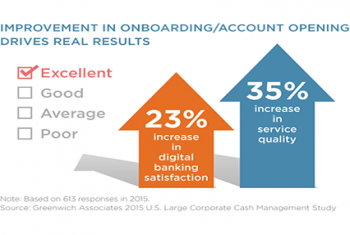

To Ease Customer Digital Banking "Pain Points", Begin with Onboarding

It is easy to focus on the bells and whistles of the feature sets, however the ROI from these outlays can be difficult to quantify, particularly for “user experience” factors such as ease of use.

In the most comprehensive study to date, Greenwich Associates assesses the current state of blockchain adoption across banks, brokers, asset managers, exchanges, and technology vendors while also capturing the opinion of the leading blockchain...

Pages

Access Free Research

Access timely info via personalized dashboard

Receive webinar invitations and set up your preference

Save Coalition Greenwich Research in a personal folder

REGISTER

In The News

-

Markets Media: “Even as electronic execution becomes the norm, the human touch has emerged as the...August 20, 2025

-

Traders: “We expect both broker-client relationships and broker competition to be more data-driven...August 19, 2025

-

Bloomberg: Non-bank trading firms have boomed in recent years by investing in technology, largely...August 17, 2025